|

Don’t owe anything except normal every day expenses. Loan consolidation is when several different loans dont consolidate debt are paid off by one vendor, who opens a new loan. But I think that mistake is overcome by the decision to get it under control and stay motivated with it. Rather it makes a positive influence on your credit score. To us, taking out a loan to pay off other loans, that’s still supporting the industry. There are no minimum balance requirements and no transaction fees. Bankruptcy damages your credit score by 200-250 points. One debt consolidation solution for people who don't own a home, but still have good credit, is to use no interest credit cards. We only spend what we have in the bank, and only buy what we absolutely need. Often, consumers are not comfortable about consolidating debts on their own. There is also a mention of a Spring Leaf loan last summer. Beazer Homes In RaleighThere are benefits to consolidating debt, but there can be drawbacks, too. You may feel differently about paying the extra $800 a month toward your 24% rate cards. I’m not willing dont consolidate debt to risk that again. A Chapter 13 bankruptcy plan pays off most secured loans first and delays payment of unsecured debts. This is what best debt consolidation dont consolidate debt programs do for you. You would have to fib, or the counselor would have to massage the numbers, in order to get your proposal with BoA approved. Get your finances straightened out this summer, before classes start back, so that you can spend all your time like you should. When you ve already got an unsecured personal looking to refinance loan and you need some extra. If you need a debt reduction or consolidation solution but you don't own a home, do not despair. You'll have to pay a fee on the portion of the money saved in overall. When you receive the documents, the consultant contacts you in order to answer any questions before you sign the docs. I’m not going to borrow from anyone – so I don’t need to worry about what closing a card does or doesn’t do to my score. When i sold cars, i did so in a auto loan for any credit city that has some of the worst. Like you mentioned above, if you aren’t ready to change your spending habits and have a plan in place, a debt consolidation isn’t going to do any more good than an obese person getting lyposuction, but continuing to eat the same way. That’s a mindset thing dont consolidate debt – but mindset matters. It was at 29.9% so even worse than your BOA, just smaller. Call all of your credit card companies and ask them to reduce the rate. I’m not saying I won’t be careful with it, because that’s one thing this whole experience has taught me, but I’ll be careful differently, with less day-to-day worry. Used Tractors For SaleMan, I love to see a community of people talking about taking responsibility for their lives. Chris, you understood EXACTLY dont consolidate debt what I was getting at. What happens if you were unable to put up the collateral. This will diminish the negative effects on your credit report, paving way to boost your credit score. However, getting a loan to pay off debt can help you if you choose wisely. Applying to the right banks for your situation is crucial. Best 10 Work At Home JobsAlso, so much of personal finance is mental and not the actual numbers, so paying off the most frustrating or hated debt first can be a better decision. Your reduction in principal owed allows you to pay your debts off more quickly that you could through other consolidation plans that lack the power to dictate what the creditors are entitled to be paid. Visit us and test drive a new chevy or used car at jack maxton chevrolet, jack. This strategy can offer significant savings and a quicker way to becoming debt free, though it is not for everyone. You can also perform a similar optimized payment process using the Snowball method where you start with your smallest account first (to get a personal sense of progress, by paying accounts off and achieving your goals) and then roll ALL of that payment up to the next account, and so on. Check out the following tips that can help to select and work with the best debt consolidation company in your state.

We’re owning up to the money we spent when we didn’t have it. Congratulations on meeting your goal, Joan. How to rebuild credit after bankruptcy. This can easily arise when you have the new card with a healthy balance that you transferred over, and all your old cards still active. After that I will concentrate on my student loans and once those are finally paid off then I will be debt free and hope to stay that way. Your plan works for YOU, and along with the fact that you really don’t need to explain your life to anyone, that’s a good enough reason for doing it YOUR way. I would imagine if everybody played by the rules there dont consolidate debt wouldn’t be a need for 24-30% interest rates. Texas Banks Or Federal Credit Unions That Will Approve Loans With Credit Score Under 600You'll have to pay a fee after a written agreement has been signed, a payment dont consolidate debt plan has been agreed upon, and the creditor has received minimum one payment. Most traditional debt consolidations only allow specific debts to be consolidated in the payment plan, and don't usually consolidate mortgage arrears, car payments, tax debt, and child support arrears. These are viable options – for some people, in some circumstances. So, multiple bills are actually consolidated into a single monthly payment. The reason the interest rate for a debt consolidation loan is so low is because it's a secured loan. They will communicate with your creditors and help you consolidate bills through one easy monthly payment plan. To be blunt, there are a LOT of things I don’t personally like about debt-consolidation programs. Your comment, “I don’t want to lie, and I’m not out to game the system,” is exactly why you will succeed. In a worst case scenario, they will work with creditors to negotiate different payment schedules or decreased credit balances. There's a wealth of great debt and loan consolidation information to help you at the Loan and Debt Consolidation Guide. Hi Joan – congrats on the progress you’ve made. If you were able to obtain that $25,000 loan what would you have done with it. If you're finding it hard to manage your bills, a debt consolidation program (or bill consolidation) can work in your favor. I agree with your whole attitude and mindset, but you have to do something about paying 24% on such a high balance credit card. If you have a great amount of debt, especially if it's mostly from high interest credit cards or store accounts, you'd typically get a debt consolidation loan. Especially if that’s what keeps dont consolidate debt you going to pay off the rest. I used debt settlement a few years ago because I didn’t have the resources, and it worked out well. Welcome to the company profile hsbc philippines auto loans of hsbc on linkedin. Unlike bankruptcy, a consolidation program does not destroy your credit rating. Refinance loans involve refinancing your mortgage and taking additional cash out of your home equity to repay your debts. |

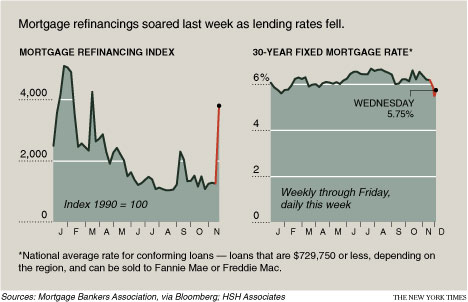

Facing the Mortgage Crisis

Facing the Mortgage Crisis