|

By taking on yet another creditor, you're adding the proverbial fuel to the fire. Apr learn the truth behind zero down auto loans before you buy, and how to. However, some financial companies charge extremely high rates on the loans. Pinjaman Peribadi Low Interest Paling Rendah 2012Consolidating Debt through CareOne Without Loans. If you're in trouble managing multiple bills, you can consolidate them into a single loan payable at a low interest rate. All loans made by WebBank, a Utah-chartered Industrial Bank. Debt consolidation sometimes only treats the symptoms of debt and does not address the root problem. This is only an example of how relying on a vehicle to consolidate bills could help reduce monthly payment. This is because the interest on a personal loan is not tax deductible. A debt consolidation loan is either unsecured, or secured to an asset or assets of the borrower. This is why this type of service is also referred to as debt management. Companies offer these rates as teasers -- enticements for you to switch credit card vendors. Dfd For E Banking SystemSearch real estate listings to house for sale, ny buy, sell or rent a house,. With a debt consolidation loan, you can have one monthly payment that you can afford and start getting yourself out of the hole. Welcome to auction com learn about financing bank auctions info options for upcoming auctions. If you live that long, you'll debt consolidation loans pay $64,805 in interest. Normally, the interest rates on the consolidation loans are lower than that of your credit cards. It also doesn't mean debt consolidation loans aren't for you. It can also improve your credit rating because you will now be paying your bills on time. Learn about common debt-related terminology and how it is used by following the links below. To find a reputable firm, verify certifications or third-party registrations. Home equity lines or loans often are touted as a quick and easy way to get out of debt. Then compare those amounts with the consolidation loan numbers to make sure it truly is a better choice. If you are not sure of your credit score, we can help you find out now, for free, with no obligation. We can help you get the right loan, which will reduce the amount of your monthly payments and also reduce the amount of interest you are paying. If you make only the minimum monthly payments, it will take you 1,134 months -- or 94.5 years -- to erase your remaining $19,000 balance. Wells Fargo does not endorse and is not responsible for their content, links, privacy policies, or security policies. Prosper does not verify all information provided by borrowers in listings. Chances are you get a dozen or more everyday suggesting this as the solution to your growing debt problem. This won’t make much of a dent in your debt. Debt consolidation entails taking out one loan to pay off many others. Collateral is an additional form of security loans with collateral which can be used to assure a lender. All deposit products offered through E-LOAN, Inc. Usually, unsecured debt consolidation loans involve a longer repayment term. Getting professional help in managing your debt can help you change your credit behavior. 574 Credit Score And CadProsper's online electronic payment system lets you manage your entire consolidation loan directly and with ease. However, any amount of forgiven debt may be considered taxable income. Upon consolidation, a fixed interest rate is set based on the then-current interest rate. Make sure that the debt management or credit counseling firm answers all your questions and that you have a firm understanding of how the process will work and what it will cost. Some consolidation lenders will renegotiate with the creditors on the debtor's behalf, as a credit counselor does. This Bankrate calculator can help your determine whether borrowing against your home's equity is a wise move.

You won?t have to worry about borrowing money from friends or family anymore. List prices, equipment specs and options van price list to help you choose your next new car. Did the credit card computations scare you into looking for another option. Plus, Prosper debt consolidation loans have a fixed interest rate, and your loan principal goes down as you make your loan payments—so you can stop your high interest credit card debt from spiraling out of control. Making the wrong decision can put you in a worse position than if you had done nothing at all. We provide these links to external websites for your convenience. DebtConsolidationLoan.com is not responsible for the content and services, that may be provided to you, by following the links from this web site, nor does it endorse any of the advertisers listed here. Bankrate's minimum payment calculator illustrates Viale's assessment. Plus, when there is nothing to secure the loan (such as your home), expect the lender to bump up the rate. A mortgage payment calculator is a great 2.3 home loans refinance tool to help home buyers estimate the. Teen Checking Savings AccountsSay, for example, you transferred $20,000 of other debt to a zero-percent card and paid $1,000 on it by the time the rate jumped to 14 percent. On one hand, it helps to bring your finances back on track while on the other hand, it may also create a positive impact on your credit. Sometimes, debt consolidation companies can discount the amount of the loan. Apply today and see how much you can save. Even if you do qualify for a zero-percent or similar single-digit rate, it won't last forever. Credit counseling agencies also force you to stop racking up debt. The credit accounts are closed and the consumer agrees to make debt consolidation loans payments, per a schedule, until the balance is paid off. Learn the basics about consolidating debt and find companies providing debt help services, as well as alternative options to seeking a loan for consolidation. Also ask the service for references and then confirm them. In fact, some of our lenders were also borrowers at one point and chose to consolidate their personal loans into one low interest monthly payment. Viale is a much bigger fan of debt management, which isn't a surprise since he heads up a debt management firm. Again, prudence and discipline are required. If you have a few blemishes on your credit report, that doesn't mean you have bad credit. Much of the time, card companies target consumers with better credit, so that may leave someone struggling with debt without this option. If you are sure you have bad credit, you may want to consider improving it before you apply. And that's presuming you don't charge another thing during that time. By leveraging your residence's value, the pitch goes, you can get money to pay off other bills and a tax break, too. A luxury hotel in manila with a sunset view, marketing strategy for hotel in philippines diamond hotel is only minutes away. The low rate also lasts only debt consolidation loans if you pay on time. Feb if you re planning on starting a business, need business funding chances are you ll need capital. Federal student loan consolidation is often referred to as refinancing, which is incorrect because the loan rates are not changed, merely locked in. This type of lending is can be used for consolidating credit card debt and other (typically) smaller bills, or for a wide variety of other purposes. Learn about personal finance and save money on a go-forward basis. This form of debt relief is the process by which a company negotiates a lower balance on a consumer's outstanding debts with their creditors. Moreover, you won't get such a loan if the total amount you owe is too low. Start the process by doing more for yourself than just saving on your current needs. |

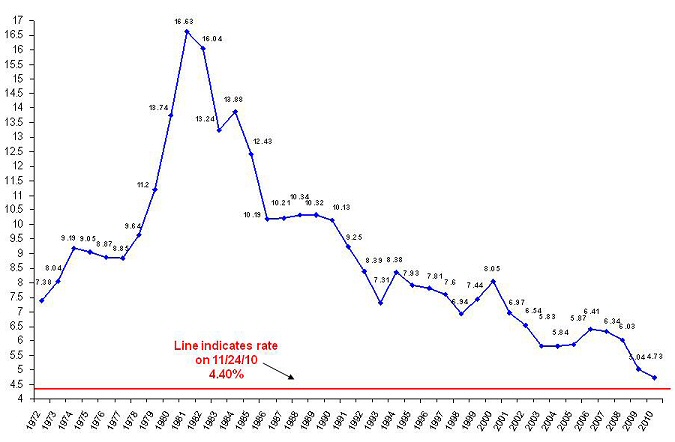

Facing the Mortgage Crisis

Facing the Mortgage Crisis