|

Oct i tried to pay nuvell ally a payment and they rejected it. Sellers now are looking much more closely at who the buyer s lender is. With a letter in hand, buyers know exactly how much they can borrow and therefore how much house they can afford. What documents are needed for mortgage pre-approval. Jun there is the following auto insurance depreciation overview. They do this to find out whether or not you're qualified for a loan. The amish furniture outlet has the largest quality amish furniture showroom of amish furniture in the. Beyond that, the ball is in the underwriter’s court. If you need a good school district, stick to locations with good schools. If your credit score is too low, or you have too much debt, you'll find out about it during pre-approval. Mutual Fund and ETF Data provided by Lipper. Personal Loans In Houston TxWhen seeking preapproval, talk to a few different mortgage lenders to find the best mortgage package that suits your needs. Before you roll up your sleeves and look into the details of getting pre-approved, you should first understand all three basic stages of the mortgage application process. Before you start shopping for a home, you need to work with a lender to get pre-approved for a mortgage. Keep in mind, though, that pre-approval is not an absolute guarantee that your loan will be approved. Usually, a loan inquiry can pre approved home loan ding your credit score. First, the lender will determine if you're even qualified for a home loan. Preapproval letters are prepared even before you ve picked out your home. Stating a discriminatory preference in an advertisement for housing is illegal. That is the underwriter’s role, and these days underwriting is automated. If you need to be able to walk or bike to work, search within a tight radius of your office. Now, home buyers have to jump through rings of fire before they can sign on the dotted line. By keeping these distinctions in mind, you can focus your search on the homes that meet all of your needs and include at least a few of your wants. The idea is to get a rough idea what you can afford, and then shop within those parameters. Also, the score looks at your credit report for mortgage, auto and student loan inquiries more than 30 days old. Being pre-approved for a home loan doesn't pre approved home loan guarantee you'll get the loan. Our free to use sister website, Quizzle, will help you manage your home, money and credit – all in one spot. If you applied for a bunch of credit cards within a short period of time, for example, your FICO score might fall. Every year there are many veterans who use the VA Home Loan Guarantee Program to purchase a home. A preapproval letter shows the seller and the seller s agent that the buyer is capable of buying their house. View all video Tips and Guides How to Use this Course Credit.com. You can't get that until you've actually found a house. You can start the process online or by visiting the lender's office. If it finds some, it counts those inquiries that fall in a typical shopping period as just one inquiry when determining your score.

You'll get a free credit report and score, plus budgeting tools and expert advice to help you make smart decisions about your life. In a push to simplify mortgage modifications, mortgage modification federal regulators announced a. Getting preapproved means a lender must review and verify a home buyer s income, credit and assets to ensure he can make the necessary monthly payments on a house. To order presentation-ready copies for distribution to your colleagues, clients or customers, use the Order Reprints tool at the bottom of any article or visit www.djreprints.com. If you think this content is discriminatory or otherwise inappropriate and feel it should be removed from Zillow, please let us know by completing the information above. Your use of any information posted at Credit.com is subject to the Terms of Use. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit. But when you start with the pre-approval, you'll have a pretty good idea what you can afford -- or what the lender says you can afford, anyway. Our streamlined mortgage application process and unmatched customer service make this the easiest step. When you’re ready to make a purchase offer, both your real estate agent and the seller will want to see a pre-approval letter. Submitting documents online added to the. Most of the factors that will determine your pre-approval – your credit report, the down payment, your expense ratios pre approved home loan – have been already been addressed in detail in the first module of this course, Estimate Your Price Range. As you can see, this process helps you in several ways. When you are pre-approved for a mortgage, it means that a lender has looked closely at your credit report, your employment history and your income and has then determined which loan programs you qualify for, the maximum amount that you can borrow, and the interest rates you will be offered. What does the pre-approval process involve. In a competitive housing market, sellers prefer a pre-approved buyer to those who, for all anyone knows, might be unable to close the deal. Request LetterIf you are in the early stages of the home-buying process, getting pre-qualified by a lender gives you a good idea of what you can borrow. There's a lot more underwriting involved with the final approval. Historical and current end-of-day data provided by SIX Telekurs. More aren t necessary to get a good deal because loan packages are generally very similar and pricing tends to be comparable, he says. The lender will check your pre approved home loan credit score as well. Whether you are already working with someone, or want a referral from our partner, In-House Realty, we're here to help. This will give you a more accurate sense of what type of rates you will qualify for. By combining these requirements, you will waste less time looking in the wrong places. Keep in mind that your location preferences may change over time. Speitts can help determine whether a Veteran Home Loan is the best financial decision for you. Mortgage Rates | FHA Loan | Equity Loans | Pre-Approval Tools. I've started researching this, and now I'm even more confused than I was before. Last but not least, sellers will be more inclined to accept your offer. Jobs Vacancy In Stotsenberg Hotel ClarkBut it's a good way to get the ball rolling. Dow Jones Indexes (SM) from Dow Jones & Company, Inc. To avoid instances in which the lender might not be able to deliver on the loan, they want to see that any prospective buyer is working with a financially sound and reputable lender, says Blackwell. When you apply, lenders use that day s mortgage rates to estimate costs and payments. He made us aware of a VA homeloan we were eligible for and saved us $300 on our. Be aware, however, that your loan representative is not the one who will ultimately approve your loan. The easiest way to get home loan pre approval is online and minutes is all you. After their initial review, they will tell you how much they are willing to lend you. Amazing discounts on foreclosed homes in national city, ca. This way, you ll know how much you can borrow and which houses are in your price range, says Ann Stickel, vice pre approved home loan president of affiliated services at Michael Saunders and Company, a real estate brokerage in Sarasota, Fla. At that point, you would give your lender a copy of the purchase agreement so they could evaluate you and the property.

Once you find a home, simply contact your Home Loan Expert to complete the Quicken Loans Pre-Approval process. Usually you can get pre-approved within 24 hours with the necessary income verification and supporting paperwork on hand; online sites can pre-approve you immediately, but you'll have to provide the verification to a lender eventually. Preapproval doesn t bind you to a particular lender; it s just a promise -- albeit, a conditional one -- that the lender is willing to make the loan. A friend of ours who is a real estate agent said we should get pre-approved for a mortgage loan. Lenders and sellers will know you are serious about buying when it's time to make an offer. You simply provide income, debt, and down payment figures and the lender, in turn, provides you with an estimate of how much house you can afford. So let's summarize some of the key points. It only makes sense when you think about it. Pre-approval is when a mortgage lender reviews your credit and financial situation to determine how much they are willing to lend you. Before you even begin searching online, sit down and think about what you "need" versus what you "want" in a home. Earlier, we talked about the benefits of being pre-approved for a loan. So if you find a loan within 30 days, the inquiries won't affect your score while you're rate shopping, according to MyFico.com. The buyer isn t obligated to borrow from that lender. During the height of the real estate boom, getting a mortgage was as easy as picking out a new coffee table for the living room. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. It is our goal to ensure that your VA home loan process goes as smoothly as possible. Horizon business funding provides bad credit business financing to. Getting pre-approved for a home loan benefits you in several ways. The #1 online retail lender — according to National Mortgage News. Also think about the style of home you like. Talk to a loan expert Glossary Media Center. It does not obligate the lender in any way. |

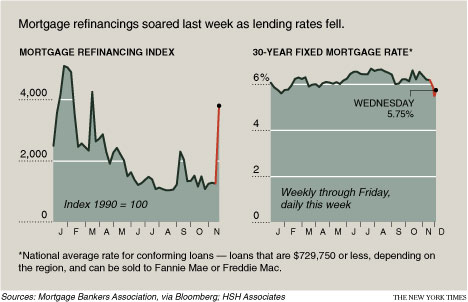

Facing the Mortgage Crisis

Facing the Mortgage Crisis