|

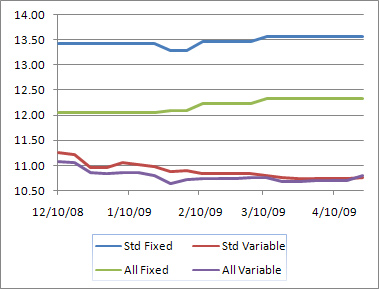

Jul white house efforts to push widespread 2.3 fha refinance rates refinancing of mortgages for about. You can get the bad credit loan you deserve in an instant. We use actual gross sales to determine your loan amount. Also our dedicated advisors are ready to meet your unique needs. Copyright 2006-2012 OnlineCheck.com/Merchant Advisors. Business cash advances are the best option for merchants with poor credit in need of small business financing. Horizon business funding provides bad credit business financing to. Other cash providers that receive their payback through credit card sales and/or membership programs can create cash flow consequences and accounting nightmares. A bad credit business loan can be a difficult proposition. If you have a high score, you'll have a pretty easy time getting credit offers from a wide variety of funding sources. When considering a bad credit business loan there are a few things to keep your eyes open for. If you're creative, you can reduce your startup costs by brainstorming a list of people who would be willing to provide you with gifts and subsidized loans. Bad Credit CashEven a FICO score of 699 score indicates a 15% chance of delinquency. For new and growing businesses, CapitalPlus' factoring services are a flexible, hassle-free solution to working capital needs, one that gives you immediate access to cash. There are several nonbank lenders on the internet that now offer microloans to entrepreneurs. How about business loans for well over $50,000 with no collateral and no equity. CapitalPlus' factoring service takes title to the invoices and collects them when they are due. Need help incorporating your business.Yes No. Get A Cell Phone And A Service Plan With No Money UpfrontIf you're ready to, you can also apply for financing. Every inquiry on your credit report will bad credit business loans remain for a period of two years. Whether you need a home loan, an auto loan, student loans or personal loans, Merchant Advisors suit your needs the best. After your loan is approved, we typically wire transfer the loan proceeds directly to your business account. Use ARF and get the cash you need without all that hassle. To compensate for this, FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which inquiries occur. Also, the FICO Score does not count inquiries a lender has made for your credit report or score in order to make you a “pre-approved” bad credit business loans credit offer, or to review your account with them, even though you may see these inquiries on your credit report. MCA is the single most unique method of financing available. If you need to avoid making debt payments, focus on getting "free" money in the form of gifts and grants. Repo Double WidesTo learn more about how FICO scoring works, download their official guide. Those that rarely use credit or don’t bad credit business loans use it at all are scored negatively. We never require collateral, and we never interfere with your credit card stream. Often times, these types of programs have hidden costs involved like funding tax and tip, or they cannibalize your sales growth by simply repaying your cash advance back using your existing customer base. When an MCA provider sees three or more of them from competitors, they may sometimes refuse to review your application altogether. Also, you can now use private loans from relatives, friends and business associates to rebuild your credit score if you use a loan management company to service the loan and report payments to credit bureaus. Getting into a bidding war hurts their bottom line and there’s no way to determine if those inquires are representative of a savvy shopper or a pattern of being declined elsewhere. Inquiries that are marked as coming from employers are not counted either. Once a week we process an ACH debit from your authorized business checking account. ARF specializes in providing working capital for restaurants, small businesses, boutique hotels, retail establishments and hospitality businesses. All loans are subject to ARF's standard underwriting criteria. For a comparison, the average rate on business loans from relatives and friends is currently at 7.6 percent, according to CircleLending's Business Private Loan Index, whereas the rate was more than 12 percent at Accion and more than 20 percent at Prosper for individuals with poor credit. It is this information which determines your score and enables credit to be measured.

After this is completed it is recommended to build your business credit. Stop turning to banks for business loans with bad ro poor credit, get the financing you need quickly. The trick is to fund your business in ways that actually get your score back on track so when you're ready to move your business to the next stage, your score will start opening doors rather than getting them slammed in your face. Writing a check, mailing it on time, and covering the payment regardless of your current financial standing is full of risks. Keeping your personal credit separated from your business credit is a step in the right direction to getting the best bad credit business loan. It may turn out that a bad credit business loans can be substituted by utilizing business credit established with a factoring company. You can see a detailed breakdown of personal and business credit scores in our credit score tables. By selling your future card revenues for a discounted price, you receive a lump sum of capital today. Applying for an MCA will involve a credit check no matter who the provider is. Be sure to shop around and compare rates since each site offers a twist on how they price loans and spread risk to their lenders/investors. Traditional loans require action on the borrower’s part to repay. Bad Credit Fha RefinanceARF requires no change in your credit card processor and does not interfere with your credit card stream. All rights reserved* American Express requires separate approval. Business credit works on a sliding scale from 0-100, with 75 and higher being excellent credit, 0-20 being bad business credit. Unfortunately, in the eyes of banks, your credit score may still not be good enough. Dec when buying a house don t assume everything 574 credit score and cad is done until your home has. Business Loans and Merchant Cash Advances. Equipment LeasingHow about some of the most competitive rates in the industry, a simple and quick approval process, and flexible financing options. Our program provides maximum flexibility with minimal hassles and loan amounts up to $1,000,000 per location. Cash advances offer the following benefits not available through bank bad credit business loans. You can make partial payments on credit card debt whereas installment loan agreements may restrict you from making partial payments. This phenomenon is creating two completely separate markets both based on the MCA system and everybody can get approved for something. Always build and maintain good business credit with the major credit bureaus. Sample Of Billing Statement In AirconIf they’re investing in your future ability to generate sales, than a high probability of bankruptcy can cause them to think twice. Bad credit business loans are great for those who need more cash flow. When you need an auto, student, or home loan, you can avoid lowering your FICO Score by doing your rate shopping within a short period of time, such as 14 days. Click the "Get Access Now" button above and start reviewing your lending matches in minutes. These loans do not take a lot of time nor do they typically require a lot of paperwork. For better or worse, your credit score has become your "SAT score" when it comes to financing. Advance Restaurant Finance, LLC (ARF) is a California Licensed Finance Lender based in San Mateo, California. Where appropriate, we assist debtors debt lawyer in nyc in preparing and filing chapter. For borrowers who don't have strong credit scores, the interest rates on loans from these sources will tend to be high. Many cash advance companies receive their payback by deducting up to 30% from your daily Visa® and MasterCard® sales, and they may require you to change your credit card processor. People with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports. There are many lenders and financial institutions that offer bad credit business loans. Why let some other company reap the benefits of your hard work. Lenders will look at your credit scores,credit reports and payment history compiled by all the major credit bureaus. This enables you to free up cash for other important purchases and expenses. You'll know what to expect and can set your budget accordingly. However, inquiries can have a greater impact if you have few accounts or a short credit history. Seek loans from your relatives and friends. While it can work to your advantage to shop around, overdoing it has disadvantages. Veterans Home LoansIf you're accustomed to credit-card-level interest rates, these rates may seem affordable, but remember this. The good thing about our bad credit loans is that you don t have to provide any type of collateral. From there, we can establish your loan needs and start the process. For years CapitalPlus has been providing companies alternative means of funding bad credit business loans when conventional business credit is not a viable option. The score allows for “rate shopping.” If you’re looking for a mortgage, student loan, or an auto loan, you may want to check with several lenders to find the best rate. Merchant Advisors is here to help you find the bad credit loans you need, when you need them most and at an affordable rate.

There will be no fax and no credit check. Your search will be long and hard--despite what you read on the internet, there is no silver bullet here. Many entrepreneurs quickly learn that their initial business loan was helpful in establishing and starting up - but expansion, maintenance or even growth requires additional funding which may not always be available. Large numbers of inquiries also mean greater risk. This statistic should provide you some comfort, because it implies that 75 percent of the money you need can come from other sources that rely less on your credit rating. Car Loan 100 AcceptedProceeds can be wired directly into your bank account. Banks use your credit history and score to determine the likelihood that you will manage to fulfill these responsibilities 100% of the time. New small businesses tend to damage their own chances for secondary financing during slow beginnings when fixed loan repayments are not always made on time. We suggest that folks with an above average personal credit rating try their local community or specialty lenders, they will bad credit business loans tend to focus on a combination of business and personal credit scores until your businesses credit is established in itself. It does not matter what your loan is for. |

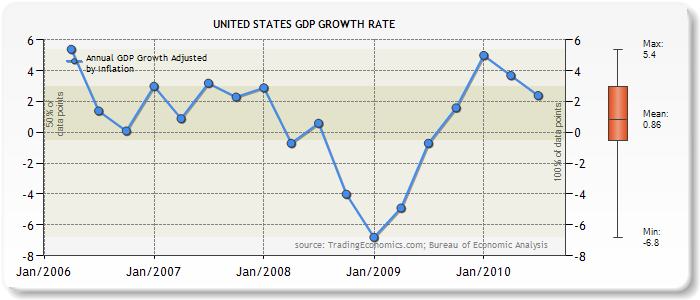

Facing the Mortgage Crisis

Facing the Mortgage Crisis