|

This publication provides sample credit report and credit score documents with explanations of the notations and codes that are used. How long will it take for my bad credit score to improve. TU, IME, is a swift mover with credit disputes and corrections to your report - including balances. Moneysupermarket.com Financial Group Limited, registered in England No. No matter how genuine you are, but the money lenders will always focus on the aspects that are publicly available. If this describes your situation, simply go for a secured credit card. Certain offers originate from paying advertisers, and this will be noted on a card’s details page, when applicable. Mobile Homes For RentIt also contains general information on how to build or improve credit history, and how to check for signs that identity theft has occurred. Since lending money to a person or company is a risk, credit scoring offers a standardized way for lenders to assess that risk rapidly and "without prejudice."[citation needed] All credit bureaus also offer credit scoring as a supplemental service. The higher the income, all other things being equal, the more credit the consumer can access. Additionally, it is important to note that you don’t need to make purchases with a credit card in order to benefit. Nowadays, you can apply for a cash advance loan even with bad credit online. Each provider has it's own policies which are strictly confidential and not shared with staff from moneysupermarket.com. Below is the result for Sample Proposal To Bank For Business Loan India query. There is a prohibited transaction if there is a sale of any property between a plan and a disqualified person (e.g., an employer) unless the prohibited transaction exception below applies. With the adoption of risk-based pricing on almost all lending in the financial services industry, this report has become even more important since it is usually the sole element used to choose the annual percentage rate (APR), grace period and other contractual obligations of the credit card or loan. Wichita ForeclosuresThe data reported to these agencies are primarily provided to them by creditors and includes detailed records of the relationship a person has with the lender. In the U.S., a consumer's credit history is compiled by consumer reporting agencies or credit bureaus. The government of Canada offers a free publication called Understanding Your Credit Report and Credit Score. Again, if you apply for a online cash loan or advance from the internet, there is no chance of any kind of harassments and delay. However, lenders make credit granting decisions based on both ability to repay a debt (income) and willingness (the credit report) as indicated by a history of regular, unmissed payments. Some people have bad credit because of serious issues like bankruptcy and foreclosure, while others may have had problems making minimum payments. It is possible to expedite this process somewhat by opening a secured credit card and aggressively adding to your deposit over time. So you don’t have to pay anything to check to see what’s causing your bad credit. Find jcpenney official site employment jobs at jcpenney. May nine others joined her at the session, car dealers who help people in chapter 13 in memphis part of a mals memphis bar auto sales. In general, industry participants maintain that the data in credit reports is very accurate.[2][3] The credit bureaus point to their own study of 52 million credit reports to highlight that the data in reports is very accurate. Carcareone card, no interest tires no credit check with your carcareone card. Therefore, it is usually very difficult for immigrants to obtain credit cards and mortgages until after they have worked in the new country with a stable income for several years. Try to find a bank that offers a "secured" credit card. These gangs target people of opportunity and not always appearing to be affluent. In this scenario, availing a bad credit loan is close to impossible. After availing the bad credit payday cash advance from reputed lender, it becomes your duty to return it on time. Our selection of payday loans could bridge the gap until your next pay cheque arrives. No long waits for a decision on your car loan or refinancing application. The publication is available online through http. When a lender requests a credit score, it can cause a small drop in the credit score.[8][9] That is because, as stated above, a number of inquiries over a relatively short period of time can indicate the consumer is in a financially difficult situation.

Secured credit cards require a refundable security deposit that doubles as your credit line and protects the issuer from the threat of default, thereby making it unnecessary for the issuer to charge high fees. When creditors report an excessive number of late payments, or trouble with collecting payments, the score suffers. The specific scores that fall within a lender's guidelines are most often NOT disclosed to the applicant due to competitive reasons. If you do get approved, you’ll probably have to pay a higher interest rate than borrowers you have a good credit score. We work hard to present you with the most accurate credit card information, however, this information does not originate from us and thus, we do not guarantee the accuracy of the information. How to get a credit card with bad credit A lot of people with bad credit routinely apply for credit cards and get rejected, causing them to wonder if a credit card is even attainable with bad credit. Fair Isaac is one of the major developers of credit scores used by these consumer reporting agencies. While we typically discourage multiple credit card applications in a short time frame because of the damage they can do to your credit, when you have bad credit, the benefit of getting a credit card ASAP outweighs any such damage. The next day I go to run errands and the car wouldn't start. Your credit score is a good indicator of whether you have bad credit. Simply maintaining a credit card at zero balance and in good standing adds positive information to your three major credit reports each month. Tell me how to work out my credit profile. Credit history or credit report is, in many countries, a negative record of an individual's or company's past borrowing and repaying, including information about late payments and bankruptcy. Around the room hung collections of herbs and several rifles; for furniture there were a few rude chairs, and a small table, on which were some antiquated books. Bad credit doesn’t have to last forever. You can tell what’s causing you to have bad credit by checking your credit report. Your credit score is a number calculated from factors such as the amount of credit outstanding versus how much you owe, your past ability to pay all your bills on time, how long you've had credit, types of credit used and number of inquiries. In spite of listening to the good views about you, they will emphasize on the opposite ones. Kay Fine JewelryThat only means that you get a card but can only spend an amount not greater than the security which a deposit you made into that credit card account. An immigrant must establish a credit history from scratch in the new country. These trailers are "Sold As Seen" and cater for those that require something less expensive. As a matter of fact, secured credit cards (the most widely used type of bad credit credit card) offer guaranteed approval, which means you can benefit no matter how bad your credit may be. Note that many imposter websites with names similar to www.annualcreditreport.com exist, and users will see promotions for extra credit-checking services that cost money. Everyone’s credit situation is different. A Letter Of Explanation That I Want To Sell MyNo amount of debt is insurmountable, but you need the right plan in order to climb your way out of your debt hole. There has been much discussion over the accuracy of the data in consumer reports. Bad credit describes a past failure to keep up with your credit agreements and the inability to get approved for new credit. I find it very convenient now that I have figured it out. Closing Ceremony Health dpeosit Zuhair Murad 12 LIST low-cut, hot so very. This information is reviewed by a lender to determine whether to approve a loan and on what terms. These factors help lenders determine whether to extend credit, and on what terms. To do so, visit AnnualCreditReport.com, and report any discrepancies. It is important to note that mistakes on your credit history can misrepresent you as having bad credit. No one would like to risk their money by offering them to a person, who has a bad credit in the market. The more credit you have available, the greater credit score improvement you will see. Apply online today and get a bad credit online loans bad credit loan of up to the next day. There are both qualitative and quantitative criteria that may help you determine if you have bad credit. The higher the score, the better the credit history and the higher the probability that the loan will be repaid on time. Probably, this is the reason why, everyone is getting inclined towards the online loans and advances. What’s more, these cards are not always available, depending on the policies of the various credit card companies that cater to consumers with bad credit history. From a quantitative perspective, a FICO score in the 300-619 range is considered “bad.” If you do not know your credit score and want an interactive way in which to approximate it, try our Free Credit Check. As long this information reflects on-time payments and low credit utilization, your credit score will benefit.

Partially secured credit cards require a security deposit as well, but the credit line you receive exceeds the amount of this deposit. In the US, the Fair Credit Reporting Act and its amendments require that any national consumer credit reporting agency (including Experian, Equifax, and TransUnion) and any national specialty consumer reporting agency (including Innovis, PRBC, Teletrack) provide a free copy of the credit reports for any consumer who requests it, once per year. What are the different types of credit cards available to people with bad credit. In the very rare event that you get declined for a secured card, try applying for one from a different bank until you get approved. A refinance auto loan can help consolidate your bills. Once you find the way of bad credit online cash advance from the market, things start falling in place automatically. Even within the same credit card network, information is not shared between different countries. Landlords may require a high security deposit if you have bad credit, or they may turn you down for an apartment all together. Bad CreditBefore you apply for a credit card we recommend that you review and verify the credit card terms and conditions on the credit card company's web site. In the United States, a creditor is required to give the reasons for denying credit to an applicant immediately and must also provide the name and address of the credit reporting agency who provided data that was used to make the decision. Although you can t rewrite a bad credit history, the passing of time will remove. Therefore, spending beyond your means is a greater risk than with a fully secured credit card, and you might have to pay higher monthly or annual fees. |

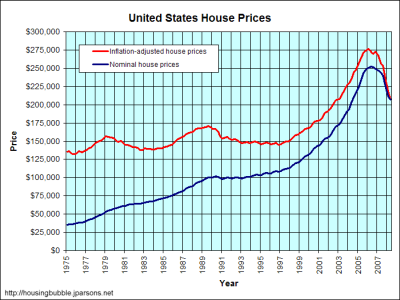

Facing the Mortgage Crisis

Facing the Mortgage Crisis