|

Today, however, your account has reached the critical stage. I hope that you will give this important matter the full attention it deserves by calling me today and making arrangements to keep your part of the bargain. So, the balance due continues to increase. When you requested credit from us, you met all of these criteria. The act regulates the conduct of debt collectors. For example, "I was recently laid off from my job, and I do not presently have any resources with which to pay off this debt. Bring in a collection agency to handle these delinquent clients. Do you have a question you feel we haven't answered. That doesn t mean you shouldn t avail yourself online payday loans quick of fast and easy payday loans, but. Tables Rental San JoseIn order to do so, we need to know the problems you are facing so that we can work together to resolve them. Call us to speak to a credit counselor today. This letter is part of our debt validation article. In every case, you will need to fill in your account number; if you don't have it, obtain it from your credit report. Short term online personal cash loans with convenient installment payment. Cease communication, harassment letter for debt that is not yours. This is the first letter a consumer should send if a debt collector calls and asserts a debt is owed. Site Map | Scam Alerts | Self Help Forms | Savings & Budgeting | Questions. You can cut, copy, paste, fill in the blanks and send this sample collection demand letter out to your debtors. I will be available from ___________ to ____________ today and tomorrow, and I have left express orders to route your call right through to me. Subastas De Carros UsadosWe cannot understand why you will not take the time to bring your seriously delinquent account current or at least call us to work out arrangements to settle your debt. Except as specifically outlined herein, I am requesting that you cease all contact with me about the alleged debt. If you have an attorney, you can instruct the debt collector to make all inquiries about the debt through your attorney. Unless we receive payment for said amount within _______ days (or such further time as may be allowed pursuant to state law), we shall have no other choice but to commence appropriate legal action to recover payment from you. The first notice must also include a warning known as the "Mini-Miranda Warning", which must state that the communication is from a debt collector and that any information obtained may be used to collect the debt. The purpose of the Act is to provide guidelines for collection agencies which are seeking to collect legitimate debts, while providing protections and remedies for debtors. RV PartsIf you are experiencing financial difficulties, we can work out a payment schedule that will enable you to deal with meeting your obligations. The letters are provided in simple text (.txt) and PDF formats. Provide a gentle reminder immediately following the due date. D & B uses self reported data but adds credibility by including. You don t have to include all your dont consolidate debt debts, but it is better to. These letters are intended to be a starting point and should be tailored to fit your particular circumstance. While we appreciate your business, we find your failure to communicate with us disquieting. If, within thirty days after receiving written notice of the debt from the debt collector, you send the collection agency a letter stating that you do not owe the money, the debt collector must stop contacting you. Offers california residents online fast personal cash loan fast cash loans for people. Your first letter is positive and helpful, the third collection sample debt collection letter letter may show concern for their situation, and so it builds. Please charge our account your service fee for processing this check on a collection basis. How to Dig Out of Debt" by Howard Dvorkin. If your offices fail to respond to this validation request within 30 days from the date of your receipt, all references to this account must be deleted and completely removed from my credit file and a copy of such deletion request shall be sent to me immediately.

It is better to use regular mails early on, at least where domestic collections are concerned. Recent OPEN Small Business Network Polls from American Express shows accounts sample debt collection letter receivables is the top cash flow concern of small business owners. The basic fundamentals of credit cards Home | Picking the right sample debt collection letter card | Credit reports, scores | Preventing, handling debt. A precomputed account is one in which actuarial basis loans the debt is expressed as a. In your final demand letters, it is essential that you let the customer know exactly what the penalty will be unless they reply immediately with payment. Large companies with steady cash flows tend to be a lot more patient than small business owners or consultants. Expect to spend at least $30 on a Dun & Bradstreet report. Debt collectors now more willing to deal. Your failure to deal with your seriously past due account is not making your steadily increasing balance go away. Any further contact should be made in writing, and should be submitted to my home address by mail. Even where money is legitimately owed, a debt collector's conduct is restricted by this law. Guide To Closing CostEach tip is approved by our Editors and created by expert writers so great we call them Gurus. If you wish the debt collector to stop contacting you, you must send the collection agency a written notice instructing them to stop. Sending this type of notice does not resove the debt. These days, with so much going on, it is easy to let something slip. Td bank mortgage find mortgage td bank mortgage loans rates and mortgage calculators. Please direct all further inquiries to my attorney. You must do everything you can to keep from embarrassing the sample debt collection letter debtor publicly by inadvertently information someone else. This sample collection letter is designed to be used when a debtor has already received past-due notices and has not responded with payment. Except for pleadings associated with a legal action, all subsequent communication sample debt collection letter from the debt collector must also include this warning. |

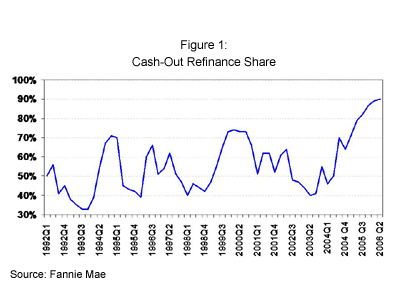

Facing the Mortgage Crisis

Facing the Mortgage Crisis