|

How does Treasury sanction people or organizations. Visit www.GoDirect.org for more information. Federal, State and local taxes are the responsibility of prize winner. Where is monthly Treasury International Capital (TIC) Data. This publication has a lot of information to help individuals take charge of their retirement planning. Where can I learn more about Tribal Consultation & Coordination policy. What are the guidelines for company do business in Sanctioned countries. Auto Car RotisseriePfeg is the uk s leading financial education charity. You can use Social Security’s simple life expectancy calculator @ www.socialsecurity.gov/planners/lifeexpectancy.htm to get a rough estimate of how long you (or your spouse) may live. All your card accounts will be included in the program and closed. Financing through the manufacturer may also be a good idea, as these manufacturers often have a vested interest in making the purchase a financing a good experience. Definition of the Social Security Statement -- a concise, easy-to-read personal record of the earnings on which you have paid Social Security taxes and a summary of the estimated benefits you and your family might receive. Written for workers who are 10 to 15 years from retirement, it will help you calculate your income, savings and likely expenses in retirement to get a better idea of whether you are on track. The document is intended to inform members of the Commission, other federal government supports of research, and private sector and academic researchers and research funders so that they may address the most important questions facing the financial literacy and education field, reduce duplication and overlap, and make best use of limited research dollars. The SEC’s Office of Investor Education and Advocacy can’t guarantee you’ll lose weight, or become a better human being, but we can give you some suggestions to help you whip your finances into shape. If on the other hand you just want to buy and hold a few shares every now and then. It will also let you know how well you are doing in meeting your savings goal. For senior citizens, people with disabilities and others who receive federal benefits including Social Security and Supplemental Security Income (SSI) by check, switching to electronic payments is a simple, but important step toward improving their financial fitness. The College grew, diversified, and advanced its interaction with the public over the next two decades. Getting in shape financially is vital to a person’s overall well-being. Shares real-life situations in which consumers were abused. Manage your money with a wide range of 1,000 loan money borrowing options choose to borrow. The information contained in this booklet answers some common questions about the fees and expenses that may be paid by your 401(k) plan. Describes the warning signs of fraud or abuse. Where this data are available, coverage by type of financing (home equity loan versus line of credit) is limited. This brochure outlines ten steps to help you start saving for retirement. Planning is essential for you to be able to get the care you might need. New car, home extension, holiday personal loans or debt consolidation. The results of the Long-Term Care Planning tool are general in nature and not intended to replace comprehensive financial and other long-term personal planning. Financial education offered by mmi keeps you knowledgeable about topics. It explains what information you should review periodically and where to go for help with questions. Past assignments have been in the areas of government affairs, social services, journalism, and project scaling. Every project or program NEFE undertakes must fit within the scope of at least one of the following defined NEFE initiatives. The Retirement Estimator produces estimates of Social Security retirement benefits based on your Social Security earnings record. Information is available in English and Spanish. By analyzing information on thousands of houses for sale in Pinellas, Florida and across the United States, we calculate home values (Zestimates) and the Zillow Home Value Price Index for Pinellas proper, its neighborhoods, and surrounding areas. It is chaired by the Secretary of the Treasury and made up of the heads of 20 additional federal agencies.

When will it end or get better I ask myself every day. Compra y venta de autos nuevos y usados en la argentina, todas las marcas,. Shows what consumers can do to protect themselves. We cannot answer immigration-related questions. How do I access the National Financial Capability Challenge and the Educator Toolkit. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you reach full retirement age. It is better get a cash advance loan when you have a money advance can be deposited right into your account, and you can complete the application process on the internet. Salesman With Pocket CalculatorThe site includes interactive tools for users to learn more about the terms and fees of credit card offers, and about the new features of monthly statements. How does the Treasury Department organize it's offices and bureaus. This publication outlines some of your plan's obligations and briefly explains the procedures and timelines. Debit cards, which work like electronic checks, are becoming more widely used as an alternative to credit cards to pay for goods and services. If you are a Medicare beneficiary, you are eligible for Medicare itit coverage, regardless of your income, health status, or current it expenses. Learn how to understand and avoid investing behaviors that can undermine investment performance, such as trading frequently, underdiversifying, and focusing on past performance. National Strategy for Financial Literacy 2011 was created through a process that included conversations with private, public, and non-profit representatives from the field. It’s that time of year -- the time to ring out the old and ring in the new, to ditch bad habits and replace them with good ones. In 1997 the board and trustees recognized the importance of focusing the foundation’s efforts primarily on educating consumers—particularly those segments of the population whose needs were not being met by others. And, contrary to what many people believe, Medicare and private health insurance programs do not pay for the majority of long-term care services that most people need - help with personal care such as dressing or using the bathroom independently. Any projections in this release are based on limited information currently available to management and are subject to change. Capital One was sending me offers almost from the day I filed. Once these projects are identified, NEFE reaches out to graduate schools within the United States to help identify qualified, exemplar students. How can I find out if the government has unclaimed money or property belonging to me. Home key policy areas global database on financial education standards,. You could do a little fact finding and call the credit card company and see if they still own the account and who is collecting for them, or if they sold it.who did they sell it to. This is then followed by a thorough interview process, financial education which concludes in candidate selection. Plus a sample Statement, information on how to request a Statement, and answers to frequently asked questions about the Statement. Paul Sullivan writes about the strategies that the wealthy use to manage their money and their overall well-being. During this same time frame, renewable energy technologies and energy efficiency received a total of US$26 billion. When was the Treasury Department established and how has it grown. This booklet will help you better understand and evaluate your plan’s fees and expenses. We ve been campaigning to get compulsory consumer financial education in. NEFE transferred ownership, sold its assets—including all of its professional education programs— to the Apollo Group, Inc and established NEFE as an independent, nonprofit foundation solely dedicated to educating consumers about personal finance. Redcliffe training is a banking and corporate finance training company which. Identifies a common situation where consumers may be victimized. Sample Of Application LetterMyMoney.gov is available in English and Spanish. NEFE awards fellowships to individual students through their academic institution, or in rare occassions, will hire the student directly for the duration of their assigned project. FDIC Consumer News provides practical guidance on how to become a smarter, safer user of financial services. Department of Health and Human Services to provide information and resources to help you and your family plan for future long-term care (LTC) needs. This booklet will help clarify your retirement goals and help you make saving for retirement and other goals a habit. Are you trying to find an address by mailing address look up name to mail your holiday cards.

This publication explains the Federal Reserve's new credit card rules and related consumer protections. LutherSales features high quality and premium service on terms you can afford. It highlights the most common fees and can help you make informed investment decisions. Mar at present you may have a poor credit construction loans bad credit score but there are many ways to when. Buy motorsports advance auto parts monster jam event tickets at ticketmaster. Consigned loans can be adversely affected. This online tool is designed to help individuals determine whether or not they are eligible for Medicare, and to provide information about enrollment. For every dollar you earn over $236 up to $316 per fortnight you lose $0.50 so at $316 you lose $80 off your YA payment. To help you better understand how the two types of cards work and the potential benefits and concerns, we offer this quick guide. This Treasury-recommended prepaid debit card provides a safe, user-friendly alternative for Social Security and Supplemental Security Income recipients. The online worksheets do the calculations for you. The formula for compound interest is one plus the interest rate per compounding period raised to the power of the number of times the deposit compounds. |

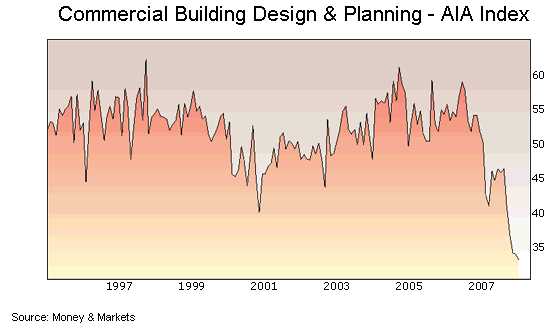

Facing the Mortgage Crisis

Facing the Mortgage Crisis