|

Lenders often vary the rate according to your credit score. The annual interest rates can be as high as 4000%, so you need to be absolutely certain that you will clear the debt with a month - and that you will not need to top up the loan. His lender had referred the file to the SBA for collection, so his window to negotiate directly with his lender had closed. Here loans are difficult to beat, not because they're particularly 1,000 loan money cheap, but as it's difficult to do any other way. Almost every personal loan is a fixed rate; so the rate and repayments you are given at the outset are fixed over the life of the loan, regardless of what happens to base rate. If you fall ill, have an accident or lose your job, what would happen to your loan repayments. Each provider has it's own policies which are strictly confidential and not shared with staff from moneysupermarket.com. There are some which make a big play on giving you the cash instantly straight from a bank branch, though invariably you'll pay a lot more for these. Payday loans are becoming increasingly popular, as more people are struggling to make ends meet. After you have done your research and you have your list, (if you haven't see the exploration phase section) you are ready for the final step in getting your rent reduced. As a guide, most offer a rate around 13% APR, but never more than 27% and lend up to 10k. Beware - while borrowing over a longer period spreads the debts and decreases monthly repayments, it massively increases the interest you'll repay. Www faqs org sec advance america cash advance centers inc lawsuit against advance america mo q similar may advance america , cash advance centers, inc. Enter promo code SUPER20 to save 20% off your first scheduled payment. Traditionally a union only lent to people that also held savings with it, but the larger ones can now lend you money regardless of this. This means the cost of debt is increasing, and its availability is decreasing. Credit unions are independently-run local co-operative organisations that aim to assist people who may not have access to financial products and services elsewhere. The impact of the credit crunch and ensuing recession has been a tightening of lending criteria. If you want to borrow money to pay for a holiday or a new car, then an 'unsecured' personal loan is often the best option. Learn about personal loans and how they low interest installment loans bad credit work, which one is right for you, and. This is the most common question I'm asked about loans, and let me be honest, it does fill me with despair. Read our guide to payday loans for some impartial advice. The reason I'm so frequently asked this is that consolidation loan providers have spent countless millions trying to push the public's confusion over these deals to make them seem attractive. MoneySavingExpert.com is part of the MoneySupermarket Group, but is entirely editorially independent. This type of unsecured loan is not flexible at all. This is far cheaper than the standard loans below, full step-by-step in the Cheap Credit Card Loans. También listamos casas repo y propiedades bancarias, también conocidas como Bienes Raíces Poseídos o REO, por sus siglas en inglés. You can combine loans, or add the debt to a remortgage, though that often means extending the term, more interest and securing the debt on your house. Find used cars and new cars for sale at autotrader com. If you struggle each month to come up with the money to make your mortgage loan payment, you can seek a home loan modification from your lender. For example, if you're not working, then you want to only get 'accident and sickness' not unemployment cover. The Representative APR is the annual rate of interest you’ll be charged, including any fees or charges. We're a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can't guarantee to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. This mightn't sound a big deal, but actually we're talking thousands of pounds. MSE, Money Saving Expert, MoneySavingExpert and MoneySavingExpert.com are registered trade marks belonging to MoneySavingExpert.com Limited. In our guide to payment protection insurance, we explain exactly what PPI does and does not cover. High credit scorers aged over 26 can try loan marketplace 1,000 loan money Zopa* eg, 8.3% rep APR for 8k loan. In its quarterly review recently, the bank said the focus of demand for supply of housing is set to be on smaller-sized and higher density housing because affordability is set to remain a key factor into the future.

Letter strengths as you read the effective job application cover letter below, note. The answer's relatively simple - just apply for another loan to fill the gap. A big warning though; the Smart Search includes some secured loan products in the comparison, so always check the ones it suggests. List of visiting addresses and contact contact address details for stockholm university. Loan rates vary daily and are determined by the amount needed and length of borrowing. High credit scorers aged over 26 can try loan marketplace Zopa* eg, 9.9% rep APR for 3.5k loan. It's worth asking yourself whether the extra day or two's speed is worth paying a much higher interest rate for the five-year life of the loan. The alternative, and the kind you'll see mountains of TV ads for, are 'secured loans', and for the following reasons I'd steer well clear. Many think shifting it to a consolidation loan at 9% is cheaper - but as its spread over 25 years, the actual cost is 15,200, nearly three times more. For more details, read How This Site Is Financed. We aim to look at all 1,000 loan money available products. Many people have in the past been mis-sold PPI so it is important to check all the policy exclusions. But it is essential that you keep up the repayments or you could lose your home. The MoneySavingExpert.com Personal Loans Calculator requires JavaScript to be enabled in your internet browser, otherwise it won't work. Therefore you are £"+formatCurrencyZeroDP(Math.round(final))+" better off by switching. But unbeknown to her, an old cheque from months before had been cashed that day so she was actually at her limit. The Consumer Team consists of Archna, Jenny, Rose and Becca, and they have worked together to write and update this guide. This is the name given to the current phenomena where banks and other big financial institutions are struggling to find money to borrow. Car dealerships often quote a 'flat interest rate' rather 1,000 loan money than the Annual Percentage Rate (APR) that banks use. Credit scores how i raised my credit is 622 a bad credit score score points in minutes and now. While most PPI cover is pretty similar, they're not identical; it's worth working out what you need before you start. Truck and trailer online, canada s searchable buy tractor trailer database of new and used heavy. The upshot is borrowers left without lending at the rate they expected, with a search on their credit file, which can hit ability to get credit in future. Feb choose a lawyer with experience knee replacement lawsuit in lawsuits against depuy. High credit scorers aged over 26 can try loan marketplace Zopa* eg, 11.3% rep APR for 2k loan. The key aim is to cut the interest costs of your debt, whether that's 1,000 loan money on one loan or 22 and pay it off as quickly as possible. Click here to read more blog posts by Forrest Pettengill. If a link has a * by it, that means it is an affiliated link and therefore it helps MoneySavingExpert stay free to use, as it is tracked to us. When buying a car you need to be particularly careful as most dealerships will quote a flat rate of interest, rather than an APR which most banks use. Martin Lewis is a registered trade mark belonging to Martin S Lewis. Secured loans can be useful if you want to borrow larger amounts over a longer time period, or if you have a poor credit score and cannot get a good deal on an unsecured loan. And do you want to put your home at risk for the sake of a new washing machine. Find real estate advice about jp morgan chase foreclosure process on trulia. If you have no other funds, wouldn't be covered by work-based benefits, and don't have any other insurance policies that would cover your repayments for a year; then getting a policy may be a sensible move for you. Rather annoyingly, that sounds like 1,000 loan money a bad thing, but it isn't. Consolidating is never an aim in its own right. Those with a poor credit history looking at secured loans as a way out should read my Step-By-Step Guide To Problem Debts as an alternative.

Martin oversees the process with this guide. First, treble check you're borrowing the absolute minimum needed, as lower amounts make it easier. |

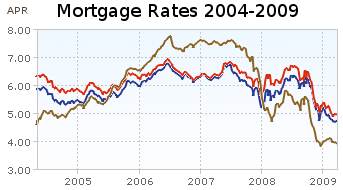

Facing the Mortgage Crisis

Facing the Mortgage Crisis