|

We will assist you in finding the best rate, term and payment for refinancing your auto loan. However, the criteria is far less stringent than that associated with home loans, says Reed. What APR % should you look to refinance a car at. According to FICO (the company that calculates the widely-used FICO scores), you refinance your auto today need a FICO score of 720 or more to qualify for the best auto loan rates. The results offered are estimates and do not guarantee refinance your auto today available loan terms, cost savings, tax benefits, etc. Calculators are provided to help you determine how a loan, line of credit or a deposit product may affect your budget. We make refinancing your existing loan easy with a standard process. Refinance your auto loan with Nationwide Bank® and save. TriMark Legal Funding LLC is one of the nation's premier lawsuit financing and settlement loan providers. The other eight member states submitted until 30 September 2011 their national plans with details of the installations and the number of allowances affected. Jack Nerad, executive editorial director and market analyst for Kelley Blue Book advises anyone in a lengthy auto loan (with an original five- to eight-year term), to research auto refinancing. It can often be handled online, and might take just one or two hours to complete. Opportunities for lighting upgrades are often abundant within a distributor's existing customer base and distributors are in the enviable position of having access to their customers' ongoing purchases. With today’s low interest rates, those who have enough equity in their home and the credit required for a refinance could lower their monthly payments considerably. You’ll also pay less over the life of your loan. But it's important to understand that refinancing your car through a home equity loan secures your auto refinance your auto today loan with your home, so if you stop making payments on your auto loan, you may risk losing your home. If the lender is willing to reduce the rate, you'll capture any interest savings without a refinancing. A car owner may have recently bought a new vehicle and financed it through the dealership. These loans are less common, but make sure to check if this is what you've signed up for. Search for new used chrysler cars for sale. If i had to pay a mechanic every time I would probably spend the $600 in full every year. Compra y venta de usados y nuevos, venta de automoviles as como lo relacionado con ellos. That tradition continues with the wide range vans shoes official site of styles of vans shoes available. I can’t tell you all the stories I have showing how much Chase cares. Reed recommends Capital One Auto Finance as another potentially good option. Check the Refinance Car Loan Payment Calculator from Up2Drive. Ulzheimer said home equity loans are a smart option if you're financially responsible because rates are good and the interest you pay is tax deductible. Request a car insurance quote from Nationwide Insurance today. As with any rate-based loan, negotiation is always an option, but Reed acknowledges that particularly when dealing with large banks, auto refinancing interest rates may be fairly fixed. You’ve likely heard about the benefits of refinancing a home loan. When using the sample letter below you can substitute the relevant character aspects of the accused that you wish to endorse or support, and which should logically relate to, and counter, the type of behaviour alleged in the court charge. Refinancing can be a great way to save some money on your auto loan if you do it right. The insurance products and services offered through these affiliates of Nationwide Bank are not insured by the FDIC or any federal government agency, nor are they guaranteed by, deposits of or obligations of Nationwide Bank.

Applying for refinancing with your existing loan is easy you just have to complete the application on this site and wait to hear back from a loan agent that can help you further. Use the money you save to pay off credit card refinance your auto today debt or accelerate your car loan payoff. In general, it's best to refinance toward the beginning of a car loan, not the end. If I refinance my existing auto loan, do you send the payoff check directly the original lender or to me. Our current selection of late model tractors tractor trailer finance include the kenworth t with. The "gentle" lenders that we recommend here like Capital One Auto Finance, Up2Drive and myAutoloan.com do not have any fees. If your lender agrees, you can promise to pay off refinance your auto today the loan all at once, at a specified date. Here's another example with the same $16,500 loan for 60 months mentioned above. Refinancing involves transferring your car's title — refinance your auto today official ownership — from one creditor to another. RateGenius not only provides customers with an average 5.15% interest rate reduction, but our customers also enjoy saving over $81/month on their car payment. The products and services offered through Nationwide Investment Services Corporation are subject to investment risk, including possible loss of value. Nationwide Bank does not offer a guarantee of the calculator results. We can help if you need financing for bank vehicle loans a car, boat or recreational vehicle. Suppose you already got a good 7% APR car loan. Now that your car payments have dropped dramatically, don't squander your savings. Don’t forget that Nationwide can provide you with the insurance you need to stay protected on the road. Money For Seniors And Those With A Disability To Buy or Fix Up A Home. Used the following link to see how refinance your auto today much your payments will change. They may be willing to refinance your existing loan and save you from switching to a new a lender. Todo autos, la comunidad sobre precios de autos autos nuevos, ventas. For auto refinance loans, we will send the check directly to the lender. However, if you have encountered damage to your credit or the car since the loan's inception, this may not be the time to refinance -- it might actually negatively affect the interest rate you get on any subsequent refinancing attempt. |

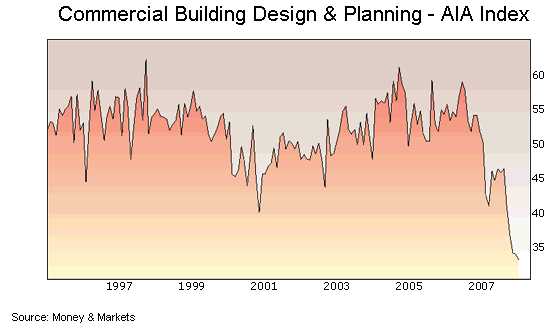

Facing the Mortgage Crisis

Facing the Mortgage Crisis