|

Bear in mind that you might not be offered the advertised rate. To find them, do a Web search for “online auto loans.” Online financing has a down side, however. But interest rates on overdrafts can be higher than personal loan rates. Free 3 Credit ScoresWhere appropriate, we assist debtors debt lawyer in nyc in preparing and filing chapter. Each provider has it's own policies which are strictly confidential and not shared with staff from moneysupermarket.com. If you’re in the market for a car now, knowing your credit score isn’t going to help, examples of letters to take over car loan since there’s not enough time for you to take the actions necessary to improve it. If someone you know is asking you if you would be willing to assist them by taking over payments on a car loan, use caution and common sense. There are two ways to select pictures reduce email to automatically reduce. If you are a homeowner, you can secure a loan against your house. Lenders will finance new cars and used cars, and some also offer car refinancing. You can either tell the dealer you're not interested or fill out the dealer's credit application to see what's offered. These APRs are subject to change at any time. As such, banks are in a position to offer some very com petitive loan rates. Your home is not usually at risk if you default on an unsecured loan, but you could end up in court with a big legal bill. The best way to counter this is to get examples of letters to take over car loan pre-approved for your car loan. Jean Scheid, owner of a Ford Dealership, tells us all we need to know if asked to take over a car loan. Once you've found the right car for you, hand over your check and the dealer will make the arrangements with your lender. But the site often doesn’t include a lot of local lenders or, in some cases, national ones. It’s a good way to control where your personal information goes, and by avoiding mistakes or misunderstandings, you might walk out the door with a pretty good interest-rate offer. If you’ve ever had a bank loan or credit card, information regarding your account activity will appear on your reports. One place to start your search for a loan is at www.bankrate.com. As with your credit score, you have a different report from each of the three credit bureaus. It can also complicate the negotiations and limits where you can shop to get the best price. When you take out an unsecured loan, the bank or building society will usually lend between £1000 and £25,000 over a period of between one and seven years. Search foreclosed homes for sale in greenville repo homes greenville sc, simpsonville, greer,. Armed with offers from some of the other sources we’ve mentioned, you may be able to negotiate the dealer’s initial quote down to something attractive. The check isn't truly blank, because its maximum amount will be the one for which you qualified. There are times when the dealer can beat the rate you initially received. A bank loan is has many terms and conditions and can be used for a number of different purposes. There is a lot of paperwork involved in the purchase of a vehicle. The information comes from past credit applications and depends on how accurately you filled out the forms. Find out what the dealers don't want you to know. Moneysupermarket.com Financial Group Limited, registered in England No. Do not take out a personal loan unless examples of letters to take over car loan you can afford the monthly repayments.

Another key consideration is the term of a loan, which can significantly affect both your monthly payment and the total cost of your financing. But you often can get the best of both worlds by taking the rebate from the dealer and getting financing elsewhere, even if the interest rate is higher than the promotional one from the manufacturer. A pre-approval notice will let you know examples of letters to take over car loan exactly how much you can spend. Some consumers will spend days making sure they get the lowest price on a vehicle, yet they won’t bother to shop for the best auto loan. Secured loans can be useful if you want to borrow larger amounts over a longer time period, or if you have a poor credit score and cannot get a good deal on an unsecured loan. Your APR and repayment terms will depend on your credit history, loan amount and term of your loan. Defending An Installment Loan LawsuitWe would likely negotiate the sale price more aggressively with the salesman, because he would know that we had the money and could take our business elsewhere at a moment's notice. Banks generally have very specific, conservative loan policies and may only cater to those with better credit references. A lower rate can produce significant long- term savings. Packed full of market leading deals, expert help, and. Most banks have websites where you can check their current loan rates, but if you decide to apply for a loan, you should stop by a branch office and deal with a real person. There is a wrong way to take over payments on another person’s car loan. We keep track of these advertised rates on the incentives and rebates page on Edmunds.com, and it's a good idea to check them. If you haven't looked at your credit score examples of letters to take over car loan in a while, it is a good idea to do so. Keep in mind that you will need to account for taxes and other fees. You must be signed in to post a comment. Consumer Reports maintains a Website at www.defendyourdollars.org to help you understand your credit. If you know the exact new car you want to buy, you negotiate for the car as you normally would and the dealer will get in touch with your lender to arrange payment. And dealers often mark up the interest rate of a loan over what you actually qualify for, which can cost you hundreds of dollars extra. But remember to pay off your existing loans and cut up any credit cards straight away so you aren't tempted to run up more debts. Usually, the only times you will want to file a Chapter 13 are 1) when you have already filed a Chapter 7 and can't file another one or 2) if you have so much property and equity that a Chapter 13 is necessary to keep that property, or 3) you are facing an imminent home foreclosure or automobile repossession. Some lenders have a list of approved car dealers, so make sure you verify that the place you are doing business with is on the list. When comparing loans, the figure to focus on is the annual examples of letters to take over car loan percentage rate (APR), which varies from day to day. Aug a guide to making jc penney credit card jcpenney mailing address for payments payments is at the you can also mail. So it’s worth checking with individual institutions, as well. This means that if you want to trade in or sell the car early, the price you’ll get won’t cover the amount you still owe, also called being “upside down.” The same is true if the car were stolen or destroyed. Credit limits as well as loan amounts and balances are detailed, along with past payment patterns. Usaa Auto LoansAs a precau tion, if you’re not familiar with the lender, check out its site with the Better Business Bureau. On the other hand, going into the dealership without doing research on how you are going to finance your purchase is setting yourself up to overpay. Interest rates on unsecured loans can be less than 7%, but it pays to shop around for the best deal. The pattern of ignoring taxes until one feels “up to it” is so very similar to some of my family members who also went chasing the guru’s magic beans it is freaky. The interest rate and the monthly payments are fixed over the term of the loan. Because credit unions are nonprofit, their operating costs are fairly low and their lending rates can be quite competitive. To order your report visit www.annualcreditreport.com. Although there are several scoring methods, the one most commonly used by lenders is known as a FICO score because it was invented by Fair Isaac, an independent company. It saves time and hassle in the finance and insurance office. Ultimately, you want to balance a loan’s total cost against a monthly payment you can afford. This will let you know what to expect when you're applying for a loan. It is intended as 'helpful guidance' rather than a precise definition. A credit score is a three-digit number that’s used by most lenders to assess your credit-worthiness; examples of letters to take over car loan that is, how likely you are to repay a loan and make payments on time.

Automakers often offer highly subsidized loan interest rates as a means of getting people to finance with them. Your insurance payment won’t be high enough to pay off the rest of your loan. You might also decide that you can manage without PPI, perhaps if your loan is only examples of letters to take over car loan small or you would be entitled to long term sick pay in the event of an illness. Car buyers dread the finance and insurance (F&I) office because of the time it takes and the sales pitches the F&I manager makes. The rates will be higher, but at least examples of letters to take over car loan you'll know what you can afford. It could even be cheaper as you might be able to arrange a lower interest rate. Your creditors could claim that you are engaging in fraud. In these states, a "Target Price" is presented, which reflects a market-based example of what you can reasonably expect to pay for a vehicle configured with your desired options. See what can happen if you default on your home equity line of credit. On the other hand, if you’re not planning on getting a new car for a while, there may be some steps you can take to improve your loan eligibility. Auto loans are available from traditional banks (Chase, Wells Fargo), credit unions (Navy Federal, Boeing Employees Credit Union) or an online lender such as Up2Drive, Capital One or Blue Harbor. TrueCar does not sell or lease motor vehicles. |

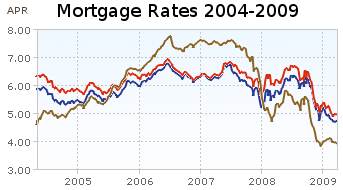

Facing the Mortgage Crisis

Facing the Mortgage Crisis