|

I have very little credit and my husband has good credit. These will ensure that you get 1 top bad credit removal the best bang for your buck. You may have to apply to several different lending companies before your application is accepted. This can be done through make payments on time, paying down credit cards, and things along those lines. A quick one is the second album by english rock band the who, released in. I am 21 years old and looking to purchase an investment property. You think none of the banks want to do business with you and you will never get the house that you've always wanted. What is the interest rate on this mortgage. You will be spending more money over the life of your loan, but at the end, you will still own the house. Whether you have been recently diagnosed with ms or have been living with the. Also, co-signing a place for both of you can be very risky in case you break up or one of you loses a job, etc… Anyways, I would hold off for at least a few years. Next, determine how much you can save for a down payment to put towards your first home. You can, however, take some of the sting out of your first home-buying process by readying yourself for the mortgage application and approval process. And how in the world am I supposed to get credit. To prevent it from going up, you may want to lock in the rate, and even points, for a specified period. When you have bad credit, you will undoubtedly be dealt some unfavorable terms as well. Currently I am the only one working, but he is supposed to be getting a job that pays about 13+ and hour within a week or two. When you try to apply for a home loan with bad credit, you might feel like the whole world is against you. Jason – without a decent size income a bank will not touch you.Your 21 , get a second job for a year or two and then look into investment property. We have saved up enough for a 20% deposit, but are wondering if that is enough considering our situation. I want to be in a house by the time we get married. Completing a mortgage application can be an intimidating task, especially if the borrower is uncertain of what information will be needed. Also, I your situation I would be very careful what you dive into. Gather paystubs and up to three years of tax returns. In addition to dealing with the high interest, you will probably be faced with other terms that you don't exactly prefer. If you have already selected a lender and are ready to apply, make sure you have the answers to these questions first. Shop around for the best rates, but beware pushy lenders. However, you may qualify for apply for a home loan an adjustable rate mortgage. The best thing for you to do is start saving for a downpayment and get your boyfriends poor credit back up to average or high. Banks hawked poor credit loans and adjustable rate mortgages like crack—tricking apply for a home loan borrowers into thinking they could afford egregiously expensive loans. If you have a cause of action to file a lawsuit, florida statute of limitations you should know that you may have.

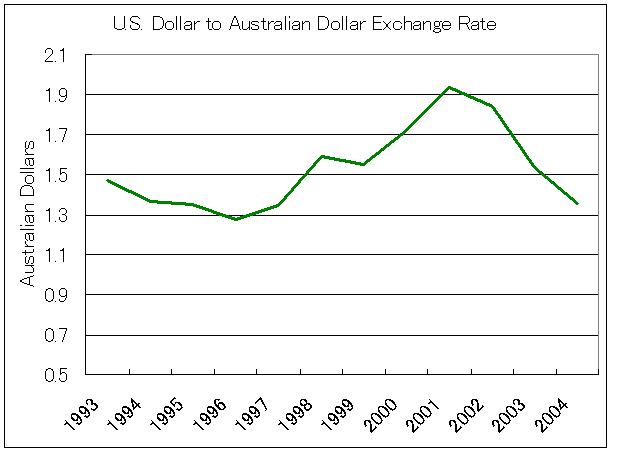

Be smart, however, and have a pre-approved mortgage in hand before going house hunting. When can I lock in the interest rate and what will it cost me to do so. Starting in late 2006, homeowners began defaulting on mortgages at record pace, and the rash of delinquencies and foreclosures devastated banks’ mortgage investment portfolios. This can be a dangerous trap to get into, though, if you are not prepared. Buyers with excellent credit may qualify for a no-documentation or "no-doc" loan, but they can expect to pay a hefty down payment and higher interest rate. If you have it, consider putting 20% down to avoid PMI—costly insurance that protects your mortgage lender should you foreclose prior to building sufficient equity in the property. Now they say they aren’t sure if we’ll be able to get the house. NO Down Payment DealersI on the other hand am 18 with no credit, which is almost as bad as no credit. I am wondering what do people in my situation do. We haven’t taken out any new debt and they knew our numbers going in. First-time home buyer programs, VA loans and other government-sponsored mortgage programs typically offer easier qualifying guidelines than conventional loans. There may be a prepayment penalty on your loan. What is the likely hood of us getting approved. You want to know what those fees will be as early as possible. They know that with your bad credit score, you have a higher than average chance of default on the loan. In order to make an educated decision about something as important as a mortgage, it's easier to first get comfortable with the process. Also, find out what the experts are expecting rates to do, read Rate Trend Index. Lenders may charge prepaid mortgage interest points to lower your interest rate or other points that have no benefit to you at all. Mortgages come with fees for various services provided by lenders and other parties involved in the transaction. Cash loans in hour are exactly as they sound. I’m engaged to my 25 year old boyfriend, who unfortunalty has horrible credit from his previous relationship. Discuss Loan Options with a Mortgage Professional - Our loan officers will carefully listen to your needs, analyze your financial situation and then present the mortgage loans and financing solutions that best match your situation. You can raise your credit score without having a credit card… just pay your bills on time. Wells fargo is with you when you want to apply for mortgage or home equity. Its taken me awhile to do this but Im finally working really hard at it. Calculators PocketGenerally, fixed rate mortgages come in 10, 15, or 30 year terms, and are the most popular mortgage type. Would your customers benefit from a free mortgage calculator on your website. As I have found out the hard way renting is a lot more exitive then buying and I also feel by renting I’m throwing my money away into a blackhole I’ll never see again. Lenders may say two weeks, but 45-60 days is probably more realistic in most cases. I hope some or all of you check out Dave Ramsey… hes heped my family and a few friends achieve what we want out of life in just a few years… and none of us are even in our 30s yet. In some cases, taxes, insurances, and fees may be equal apply for a home loan to or greater than your actual mortgage payment. Many experts advise against using a lender or broker who is unwilling to do so. Is there a prepayment penalty on this loan. Credit cards get people in more debt than help them. Nearly 75% of all home apply for a home loan mortgages are FRM's. An fha refinance mortgage or new fha loan allows for the refinance or to. What is the minimum down payment required for this loan. Since then, banks have tightened their purse strings.

You’ll know where your approval chances stand and roughly how much house you can afford. Asking price is only $84,000, but I would like the extra in case of needed emergency repairs. To effectively compare different lenders' programs, ask for the annual percentage rate (APR) of the mortgage interest, which is generally higher than the initial quoted rate because it includes all of the lender's fees. You will not just be able to walk into the first bank you see and get a home loan on the spot. My credit score is 738, but I have very little credit history, and only a $1000 limit credit card. Hi, I’m 18 years old from Warren, Ohio and wanting to buy a house. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis