|

If you have the credit score (estimate your credit score), and the debt to income ratios (which rental property loans change with each property you buy), you can pretty easily finance up to four properties. No one wants to give me money, so now I’m looking at lower price-point homes. But, in order to get into the rental property investment business, how do you obtain mortgage financing to purchase your first rental property. Jul transporte de carros de golf subasta de carros en attleboro otros veh culos activos. Mortgage brokers charge a fee for their services. The underwriter can change lending standards (often during escrow) or decide that they want to pull out of the deal at the last minute. FOR ONLINE AUCTION Tuesday, June 25th Orbitbid.com (1) Complete Draft beer dispensing system including, (1) Banner Perfecta Pour power pack Model number 60835 related lines and components are inside cooler, and including (6) Station bar tap. Small homes, log cabins, and offices delivered to your land ready to move. Luckily, after speaking with dozens of lenders, I found one company (a direct lender) that could make the deal happen. Loans for rental property will be long-term notes, usually for 30 years. She holds a Bachelor of Arts degree in English/journalism from Old Dominion University. The nice thing about the Lender I work with is that they’ve help me set up a plan to get the maximum amount of loans possible. Mortgage calculator for investment property or rental home cash flow and net. So, for a $120,000 property, that could easily be $40,000 cash needed. I also collect welfare so I can use those payments to pay the house. We have the network to get you the money you need. Having jumped through all of these hoops, I vowed that I would never make the same mistake twice. They want to see that you’ve been at your job or working in the same industry for at least two years. The #1 online retail lender — according to National Mortgage News. I am 37 years old and haven’t had a job, well, since forever. Leonard Baron, MBA, CPA, is a San Diego State University Lecturer, a Zillow Blogger, the author of several books including “Real Estate Ownership, Investment and Due Diligence 101 — A Smarter Way to Buy Real Estate.” Read useful tips for real estate buyers in his blog, Making Smart and Safe Real Estate Decisions. If times get tight and a person has to choose between paying his own mortgage and making the monthly payment on his investment property, he's going to keep the roof over his own head every time. Buying a rental property – before spending a cent or looking at properties make sure you take time to educate yourself. What issues will I have with a mortgage lender. His latest venture is The Buy and Hold Guys, a real estate investing blog. This is the second time for us to visit this location, it is a good one. Let’s say you just want to buy it as a straight rental property. I am interested in getting into rental property investments, however, I am retired and can not show employment salary right now. The Kellers built the loader to help a farmer mechanize the process of cleaning turkey manure from his barn. That's especially important if you're going to the traditional lending market because the requirements have tightened for banks that sell their mortgages, says Robert Galbraith, an attorney in Rochester, N.Y., with more than 15 years of experience in handling residential and commercial mortgages. Are you trying to buy an investment property and have questions about getting financing. While the application process for rental property is fairly similar to that of an owner-occupied mortgage, rental property loans the financing for renovating and reselling houses is completely different, Hancock says. An acceptable credit history is necessary to finance any type of real estate.

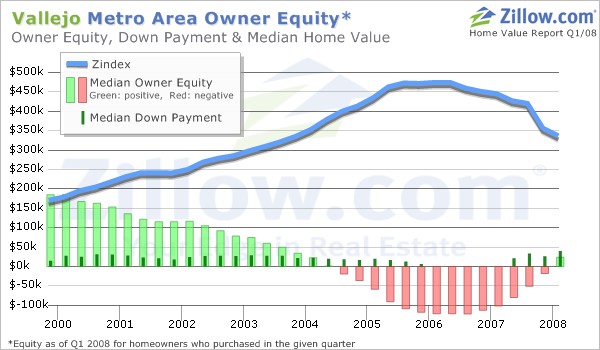

Robin is a San Diego-based mortgage lender for First Cal. I am seriously thinking about purchasing a cabin in the mountains that is already in a turn key rental business. Below you will find the most frequently have a car donation question asked questions about car donations. Minimum credit score requirements for fha home loans depend on which fha. Different lenders have different programs and a bank may reject you but a mortgage broker might have a program that works for your situation, so check around. Right when you start you should meet with two to three lenders and see what NOO loan programs they have for what you plan to buy. Copyright © 1999-2012 Demand Media, Inc. Arthur Garcia is a friend of mine and a successful real estate investor. Loan costs and rates will also vary, so get a couple of estimates and compare them to find the best deal. However, Tavistock Restaurants may share personal information within the company and with its affiliated companies. Your level of experience may determine how much of the rental income they include as your income for the loan. Pull your credit before approaching a mortgage lender. Boost your credit score by paying down debts and maintaining a good payment history. Looking back on this transaction, I wish someone had shared with me the lesser-known aspects of obtaining rental property loans. Convey this to the listing agent so that agent can alert the tenants either way. Hence, lenders consider investment property a riskier loan and will charge a higher interest rate or points than in a traditional mortgage. Carros Baratos OnlineThe loan stays in place with the original terms when you move out and make it a rental. Children are safer when properly secured in a rear seat in the appropriate infant, child or booster seat. Oakwood homes of greenville nc, is a leading source for quality customizable. It allows buyers to roll rehab costs into their mortgage, putting the money into an escrow account that a contractor can draw from to perform the work. RE isn’t like stocks or Bonds, once you buy it, you’re stuck. Lending services provided by Quicken Loans Inc., a subsidiary of Rock Holdings Inc. These Deed of Absolute Sale is free to copy and revise for single use but not for re-publication in print or in any other website. If you are self-employed, you’ll need to provide two years of tax returns, a year-to-date profit and loss statement, and most likely a letter from your CPA confirming the validity of your previous tax returns. I initially began purchasing rental property as a way to diversify my wealth-building strategy. These individuals and corporations are seasoned investors, and they finance various real estate projects. In addition to this, you need to determine, what type of investor you are – passive/active and what model works best for your – flipping, wholesaling, buy and hold or note investing. Once in escrow, do a little looking around the apartment and talk to the tenant to make a determination if you want to keep them or terminate their lease when it ends. Find cheap used cars for sale at local queens county ny dealerships used car. Sama recommends that buyers consider two other options. If I go to the bank and show them my current assets, which are pretty expansive for my area (currently have 3 homemade trailers hooked up together, so one big one) would that be okay. Meanwhile, building owners and project sponsors are calculating their own estimations to develop conceptual estimates or perform a “reality check” on bids they receive. But before you head out with a real estate agent to pick out your nest egg, there are a few things you should know about the financing. I decided to pull my money out of the financial markets and reinvest it into building a strong rental portfolio. When I first began real estate investing, I made the mistake of using a broker who didn’t understand the investing landscape. And non-owner occupant (NOO) investment properties are even higher. So far so good.i needed a cpu with windows 7 and found this one at overstock.com and this dell works great. Separate living, family, and dining rooms with hardwood floors. Higuera primarily works as a personal finance, travel and medical writer. But the present rates are really very competitive and you can get NOO financing at 4.5% on a 30-year amortizing loan these days. His second choice for financing is private lenders, people with cash who are losing money in the stock market or making 1 percent to 2 percent in certificates of deposit.

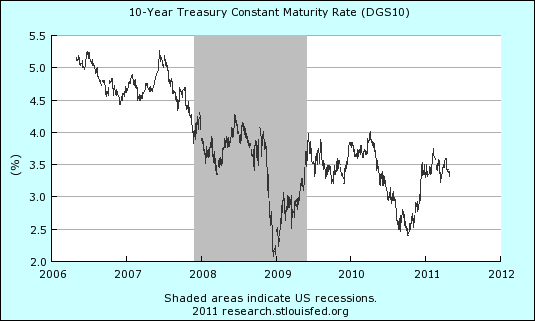

In the end, I ended up receiving a lot of bad advice and it almost cost me several deals. If you can't qualify for a traditional loan, use a private real estate investor. It’s fully furnished from silverware to sheets. Potential Panthers relocation 'scares the hell out of me' on Monday, November 5th. For terminology purposes, when you borrow for a rental property, it is called non-owner occupant (NOO) financing. If you suspect an illness resulting from the consumption of bottled water, you should contact your local public health department. Contrary to popular belief, now is a great time to buy rental property. Fannie Mae currently allows each investor to carry 10 loans at once. Have advice to share about getting a mortgage for rental properties. For approved loans, processing fees are automatically deducted from the loan proceeds and any payments required should only be made directly to the Bank and any of its accredited payment centers. And that is dirt cheap, locking in a 30-year rental property loans low interest rate loan on a rental property. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis