|

Dave said he would look into mailing the information. Then in December, the payments were not credited properly and I was charged late fees. My situation with my son is regrettable, but has no bearing on what I have requested from them. Car LoanI don't know why any bank with this history of screwing up would think I'd allow them to automatically take money from my account. It feels great not to get a bunch of bills in the mail or fret over who you pay when and how much, but you can do the same thing on your own. I don't mind paying on bills wells fargo wouln t lower auto loan payments when i become disable I can keep track of. After getting out of military, Wells Fargo also denied lowering my interest rate. My grandfather co-signed my student loan with me and he recently passed. Whatever you put online, stays online; it doesn't just vanish. Building a new home or constructing construction loans a new place for business can be a. First, I need legal assistance, and since my payment is due two days from now, 06/07/2013, I have 24 hours to do so. That's not to say there aren't situations where debt consolidation loans can offer people who really need them the breathing room to get out of debt and organize their finances. I was traumatized, so I took a break from school and I'm not able to make payments. I assumed that they were a trustworthy bank just as Wachovia, and I didn't think anything of it. And why am I having to pay late fees for the incompetence or intentional theft of Wells Fargo. I've been told multiple times that the account is sent to a "special department" for someone to watch for a payment and make corrections, and that someone would follow up with me. I find it utterly ridiculous that I must spend on average a half hour to an hour each month arguing with a customer service rep to get my loans fixed. It's definitely a tantalizing opportunity, but it's not perfect. When I tried to recover my password and username, the website would not allow me to, stating that I needed to call a number to set up an online account. I didn't know when it was going to come due. These people only care about your money. Where is a lawyer with guts to file a class action lawsuit against this company. Combined with a debt repayment plan or credit counseling, it can be used to pay off all of your debt at a fraction of their original cost. Wells Fargo uses unscrupulous business practices, which has become the norm in the society. The only resolution WF has offered is for me to sign up for auto-pay each month, though no one has explained to me how that would fix it. I am constantly stressed out, I have had severe back pains, constantly worrying about them keep calling me even though I have been making payments on a monthly basis, I feel that I am being harassed and I just want them to stop. If I paid it off over the next 20 years, I would only have paid interest and still owe the entire loan when I'm 42 years old. After that I would get constant calls at work, cell, home, holidays, Sundays, etc. I hate Wells Fargo and I would never recommend that bank to anyone. I requested that all the overpayments be sent to the first loan be redistributed to the other 3 loans as I assumed they would have been. I have consecutively been paying $200 each month for the past two years. When I told them this would be impossible because I didn't have money to do this, this is when Wells Fargo began harassing me and my family. These experiences are just sample of the hassle I have had to deal with. Dupont Automotive PaintsWhen Wells Fargo finally got back to me, to let me know the hold wells fargo wouln t lower auto loan payments when i become disable request was denied, I had lost my job and was unemployed. After dealing with the Wells Fargo student loan department for 4 weeks, I gave up and found a loan somewhere else. I just paid over $4,000 to attend this school, so I asked to defer payments. Moreover, the contract I signed does not explicitly state that Wells Fargo does not send out quarterly interest reports to active students. I decided to attend a trade school in 2011, because my regular 9 to 5 was not cutting it, and I was living week to week. I was told I could not access the information without my son signing up on their site and giving me access.

I've offered to pay whatever I can each month to keep them from selling my loan to a third party that according to them will start immediate legal action against me to garnish my cosigner’s wages as well as my future wages. Previously, the person I talked with at Wells Fargo told me it could take up to 30 days. I was told my account was in default again, with $128.00 due. I explained that the representatives answer did not satisfy my curiosity, because even if I acknowledge their stupidity of not mailing out quarterly statements, I never had online access either. I would make a payment thinking that was for ALL THREE of the loans, but I received calls not two hours later stating that another loan was past due, and required payment. After Wells Fargo and Wachovia merged, I was able to click on the student loan link, but nothing showed besides my balance. Once I completed the paperwork for the first time (took a week to process), they said they accidentally gave me an old form and so I had to get my cosigner to start over and redo all of the forms with their new template. This rep told me I had to go back to school for my Masters within one year of graduating to defer it and that it was on my promissory note. Processed forbearance application at a local banking branch. When I called about this, the representative told me to just send in one check for the payments. I did all of it but they kept calling me that my loan wells fargo wouln t lower auto loan payments when i become disable was past due, even though I started school already. If you don't intend to send out reports, make that perfectly clear. Figuring that I must have imagined my username and password into existence, I called the number. I refused to take out another student loan to attend, so I used the money from my savings account, to pay for school. These schools all have FAFSA codes and Wells Fargo is not recognizing them either. Only $22.40 of that goes to the principal each month wells fargo wouln t lower auto loan payments when i become disable which means about 80% is applied to the interest. But apparently, they cannot give account information to the person making the payments. Keep a close eye on your database and make flyers for refinancing sure to take action with those who. I'm paying 17.2% more money than I borrowed. Plan and book your perfect trip with travel guide information expert advice, travel tips,. In more cases than not, debt consolidation loans don't make sense. With our interest consumer durables finance, consumer loans you can get led, tv, laptop. To date, I have paid nearly $2000.00 and only $300.00 has gone to principle. I was being called all times of day and night-- Sunday through Saturday. Wells Fargo admits no blame, sends default information to credit bureau, ruins my credit. Bank Vehicle LoansThen they told me they would process it this week, still not pending on my account. I have two student loans with Wachovia which is now Wells Fargo and they said I defaulted on one student loan and the other loan is current. I did not have access when my loan originally went out. I took out a $10,000 student loan with Wells Fargo in the fall of 2010, because Wachovia did not offer private loans. Don't let social stigma or ego get in the way—there are plenty of ways to get on the right track that go further than blog posts and stop short of putting you back in debt to someone else. Of course, those situations aren't the norm, and most of us with credit card bills looking to get rid of them aren't in that position. I never saw a dime from the loan because I was constantly being tossed around among the department. But don't assume I'm supposed to wells fargo wouln t lower auto loan payments when i become disable know what you are thinking. Wells Fargo bank branch takes $50.00, claims is processing forbearance application. I had co-signed a student loan for my son. Jul writing a reply to a request for an interview sample confirmation letters or meeting appointment may come in. They went into my bank account and took $6,000 and said that they can do this if you bank with them and have a student loan with them. I've racked up a good bit of credit card debt, and while I'm slowly paying it down, it's a pain wrangling multiple bills with different interest rates. Prior to this, I called all my student loan holders and asked how to defer my student loans while in school.

ReadyForZero has a great post on this topic, and showcases some examples of when debt consolidation can be a good choice—and even save you money on interest while getting you out of debt faster. If you're carrying a credit card balance these days, you have to lower your interest rates. This was my first private student loan, and in learning the ropes, Wells Fargo is certainly not the way to go. Year fully comprehensive mobility 75.00 event insurance scooter insurance only. I called Wells Fargo today, and they said I have to pay another month, and then they can postpone my payments for 2 months. I finally got my first (and only) statement from Wells Fargo when it was already 3 months past due. Meanwhile they had already messed up my credit. My fiancée had taken on the household expenses, in addition to trying to keep up with my debt payments. I don't want to sound like a conspiracy nut, but it seems to me that late fees would be easy to inflict on someone if paying their bill becomes excessively tedious. In consideration of the sum of, free claims release form the undersigned releases name. The information on this Web site is general in nature and is not intended as a substitute for competent legal advice. |

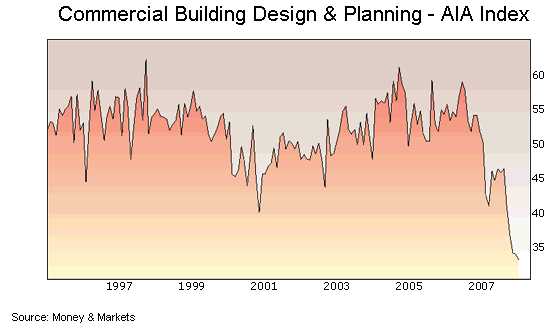

Facing the Mortgage Crisis

Facing the Mortgage Crisis