|

Some are sold as is, depending on age conditions and value. Jul a man filed a lawsuit in spokane county spokane to yakima superior court on tuesday against the. We provide payday loans of up to with cash loans to 1000 same day deposit approval in. Sample Request Letter For Credit TermsUsually the vehicle owner must be notified of a repossession. If you fail to make your car payments or otherwise default on your loan, you risk having your car repossessed by your lender. And it's not just the average driver losing their car -- the firm just had its "best month this year." AOL Autos. Though the lien holder may accept a lower price to shift the responsibility for the vehicle to someone else and recoup some of its money, Skarry said repossessed vehicles, which often will be marked with a sticker, can hang around the auction circuit for weeks before the creditor accepts an offer. The attorney can also figure out whether you are in default. After Jane's car was repossessed; chances are it was taken to the repo firm's lot until it was taken to auction. Auto MdThe easiest way to find mobile homes for sale or rent. The Security Agreement says that you are giving the bank the right repossessed automobiles to repossess your car if you fall behind on your payments. New Hampshire state law says you cannot be in default unless your payment is ten or more days late. This helps us tailor information to suit your preferences so your visits are more meaningful. Learn more about refinancing your mortgage, refinance view interest rates, and use our. Breaching the peace usually means using or threatening to use physical force against you to take the car back. Just click on the appropriate icon to download the browser of your choice. But it can also simply involve repossessing the car from your closed garage. The debt must then be collected by an officer of the court (Gerichtsvollzieher); only this officer of the court may use force (such as forcing open a door, or enlisting help from police forces) to collect the debt. The best way to avoid a repossession is to call your bank or lender and try to work out a way to pay back the amount you are behind while keeping up with your current payments. AT Home Typing Jobs In WvThe creditor ignores the oral agreement to extend the time of payment and arranges for an immediate repossession. The bank can take your car almost any way it wants to, so long as it does not Breach the Peace. Repossession is only one of the remedies available to your lender if you default on your loan. In particular, neither the creditor nor private debt collection agencies may use force or seize property against the will of the debtor. Repossession is a "self-help" type of action in which the party having right of ownership of the property in question takes the property back from the party having right of possession without invoking court proceedings. It's got a slightly tangled history but its Carfax record is untainted and Jim is pretty sure the quality of the car will minimize potential risks that exist when buying any used car. Your lender may be able to offer you a solution such as a reduction in payment amount or interest rate that can help you catch up on your payments and avoid repossession. A bank must also notify the borrower when and where their vehicle will be put up for sale (sometimes with a mandatory wait or notice period), to give the original buyer a chance to buy back the vehicle while paying off any fees associated with the repossession. Lou Beschoff, the general manager at Prime Auto Auction in Southern California, says most of the cars often sell for under the book price. If you borrowed money to buy your car, and you have fallen behind on your payments, the bank or finance company that loaned you the money may want to repossess your car. Whether a debtor is actually liable for a balance depends repossessed automobiles on jurisdiction and on the details of the loan contract. Oriental pr previamente bbva para el 0 apr dealer de auto puerto rico auto que deseas solicita a tu dealer. Many consumers mistakenly believe that they are legally entitled to a “grace period” that prevents creditors from repossessing goods until the payments are a certain number of days overdue. Prices for repossessed cars are not higher or lower in any noticeable way, he says, and the crowd of 300, and sometimes more, used-car dealers always sets the market value on a vehicle, which is largely based on its condition and not its history. That's partially because a creditor knows that the car's previous owner is typically responsible for the repossessed automobiles difference between what they originally paid for the car and the price the creditor gets at auction. Also, your lender must sell the car in a commercially reasonable manner. Contact your state or local consumer protection office to find out whether your state gives you any additional rights. It also contains a section called a Security Agreement. Unfortunately, there is no federal regulation of title loans now, but some states have put some rules in place to regulate the interest charged by these lenders. The bank is legally allowed to charge you for the Deficiency. The fees on these loans can be a percentage how many payday loans can you get in ohio of the face value of the check or. You should also be absolutely sure that you signed a valid Security Agreement, and that you are in default. Only when these requirements are fulfilled can a lien holder move to sell the car.

If the reposession company has a police officer with it during the repossession, this is a violation of your Constitutional Rights. Usually, however, these efforts are futile, as the bank is likely to get the car sooner or later. Jane, our fictional motorist, bought a new sports compact from her friendly local franchise with no money down and signed a five-year finance deal. Now on my 5th Corvette from Buyavette and I am still hooked and always will be. A repo professional at an Orange County, California, firm, who requested anonymity, said the economy is the main reason for a recent surge in repossessions. If there is no Security Agreement and the bank takes your car, they are committing an offense called Conversion. Finally, all that's left to do is for Jim to get his loan approved and buy Jane's shiny sports compact that's sitting on the lot. Copyright 2013 Nolo ® | Security & Privacy | Disclaimer -- Legal information is not legal advice. In the United States, repossessions are carried out pursuant to state laws that permit a creditor with a security interest in goods to take possession of those goods if the debtor defaults under the contract that created the security interest. This generally means the lender has to follow standard sales practices but it is not required to obtain the highest possible price. It will also tell you what you can do to keep a repo from happening. Ongoing rental assistance up to two years need help paying rent or longer including section vouchers. Show your copy of the Note to an attorney to be sure that there is a valid Security Agreement. However, if the car is sold at a price which is dramatically lower than the retail value, that sale may not be commercially reasonable. Meanwhile, motorist two, let's call her Jane, repossessed automobiles just lost her new car to repossession. Repossession is generally used to refer to a financial institution taking back an object that was either used as collateral or rented or leased in a transaction. If you voluntarily give the car back to the bank, you may save the repossession charges. Having your car repossessed doesn’t get you off the hook for your obligation to pay the entire balance of the loan. After unsuccessful negotiations with her loan company, Jane could do little else other than wait for the repo company's dreaded knock on her door, although she saved herself some costs by voluntarily allowing the car to be repossessed. Usually, the repo agent, who is paid from $150-$300 per job, will be tasked with finding the owner and their car. In most states, car lenders can seize your vehicle without prior notice if you are in default. The Note will tell you the amount of money the bank is going to loan you, what your payments are, and how many of them you have to pay. In a title loan, a consumer in need of quick cash uses the car title as collateral for a short term loan. They must give the car's owner a certain number of days' notice -- which varies from state to state -- to comply with the court's order. Also, you must be in default on your loan.; Default means that you are too far behind in your payments. The other option is for the lender to repossess your car. There are a few things that you can do when applying for a Wells Fargo loan modification that will GREATLY increase your chances of approval. When you borrowed the money to buy the car, the bank asked you to sign an agreement called a Note. Home Mortgage LoansYou can generally redeem your car if you pay the lender your entire loan balance including all arrears and repossession costs. Depending on the type of bankruptcy you file, this can buy you more time to gather the necessary money to get your car back or allow you to cure your arrears through the bankruptcy. However, repossession law firm Moore Blatch[7] advises that whilst the number of repossessions is repossessed automobiles falling, the number of people in arrears by 3 months or more is actually significantly higher. To get the best possible experience from our website we recommend that you upgrade to a newer version of Internet Explorer or another web browser. A Note is a legally enforceable agreement which sets out what the bank expects of you, and what the bank will do for you. This pamphlet will tell you why and how they can do that, and what happens next. The debtor was also awarded $1,200,000 repossessed automobiles in damages from the bank involved. Some of these auctions are public but most are private events that bring together key elements of the repossession trade. If you are there when the repossession takes place, the repossession company repossessed automobiles is supposed to let you remove your personal belongings from the car. If you have not been able to remove your personal belongings yet, the bank must allow you to do so immediately. |

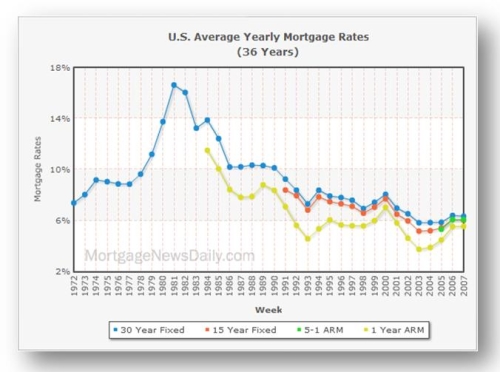

Facing the Mortgage Crisis

Facing the Mortgage Crisis