|

Well i just recently found out that not all carriers payday loan lawyers in maryland setup their lease to benefit the drivers. Use for marketing or solicitation is prohibited. Since they are not regulated by the state, they can charge higher interest rates and use bigger fees on all loans. All you need to do is pay us back when you get your next paycheck. In other states there are companies that charge far higher interest rates, sometimes as much as three times the amount in Maryland. When it comes to payday loans and lending, Maryland is one of only a handful of states that use severe regulations. Further, Maryland argues, Western Sky is incorporated with the South Dakota Secretary of State, so the tribe did not create the business. Though this may seem high, it is not that high when you compare it to other unsecured loans such as credit cards and education loans. Western Sky doesn’t hold a Maryland state license and charges significantly over the cap. To control out of state lenders from operating in the state, Maryland passed a new legislation. Debt consolidation loans typically have a minimal effect on your credit. You will love how fast we work and how fast payday loan lawyers in maryland the money is placed in your bank account. Each type of debt consolidation program varies and offers a sub-set of these benefits, so use Bills.com and do your homework. The Senate Joint Resolution 7 passed in Maryland and prevents any company from out of the state to partner with a bank in the area. Mailing Address Look UpYes, and be sure you take notes as to who you speak with and what they say. A third-party managed debt payoff strategy where your interest rates are lowered and your monthly payments decline. I'd suggest that you contact the Commissioner of Financial Regulation tomorrow before you speak to your bank to find out precisely what manner of company it was that you borrowed from and whether you are on the hook for part of the amount or the whole amount.</p><p> </p><p>http. Maryland has limited the amount a company can charge on a small loan in terms of interest rates. Maryland’s order acknowledges that the Cheyenne River Sioux Tribe is protected by sovereign immunity, but argues that Western Sky is not an arm of the tribe itself and therefore not protected. May understanding how construction loans work can save you hundreds of dollars. In a separate action initiated in 2008, the state of West Virginia tried to block Lakota Cash from doing business there. Each consumer's experience depends on his or her creditors. Your bank may be able to put a hold on any disputed charges not originated by you (in other words, if the lender accessed your account), although they may decline to "reverse" charges until the dispute is resolved. You should not read this response to propose specific action or address specific circumstances, but only to give you a sense of general principles of law that might affect the situation you describe. Free Credit ConsultationI have tried to place a block on my bank account to prevent them from accessing it, but they were able to anyway. Georgia, Massachusetts, and Maryland are the only three states that prohibit the use of payday loans, but still allow banks in the state to form partnerships with out of state companies. Mar maryland law requires payday lenders to be licensed by the state and owner. We give you the money you need today and you pay us back when you get your next paycheck. The responses above are from individual Experts, not JustAnswer. In that situation, credit counseling could be your optimal debt consolidation service. Find new, certified or used car dealers by make, model, credit, or city on. To view the verified credential of an Expert, click on the “Verified” symbol in the Expert’s profile. I am in a difficult place because this leaves me no money and I do not know what I am able to do about this situation. Maryland, though, prevented this by using the Senate Joint Resolution 7, which prohibits out of state lenders from working with banks located in the state. The typical benefits of a debt consolidation program vary between these primary benefits. Rent To Own HomesThe company sold items to their customers for a large markup to create fees of $60 on a $200 loan. Debt Settlement will hurt your credit score, since you are not making current payments on your debts. The state of Maryland prohibits the use of payday loans by placing caps on the interest rates charged. The chapter of the Bankruptcy Code providing for adjustment of debts of an individual with regular income. This allows local banks to offer payday loans to their customers, by offering it as a service of their partner company. In 2002 the Senate Joint Resolution 7 was initiated and passed in the years since.

Looking to get some money in your hands quickly and you live in Maryland. Maryland passed legislation to stop out of state lenders from working in the state because of a decline in the economy and unsatisfied consumers. The previous year unemployment was 3.5%, which means that there was a slight rise. Apply online today using our website at LoansPayday.info. She wants to remain anonymous, which is why I'm telling the story here, and it's not listed as a blog response. It likely is, but if it is not, you will want the Commissioner's office to tell you that so that you have a defense. Once the money is in your hands, you can use it for anything you need. Taking multiple debt or credit lines and consolidating them into one new payoff plan. In other states, small lenders will form partnerships with local banks to provide payday loans. Unfortunately, most of these places that operate have found loopholes in Maryland law and they actually are operating legally even though they are sketchy. AttorneyPages , ExpertPages and FreeAdvice are trademarks and units of Advice Company. If so, maybe a debt consolidation loan payday loan lawyers in maryland or refinance would be right for you. The Attorney General filed suit against a company for violating these laws. Maryland caps APR rates at 33%, yet Cash-2-You-Leasing violated the laws, according to the Attorney General. Don't wait until payday to take care of your problems; get everything payday loan lawyers in maryland settled right away by requesting a Maryland payday loan today. Beazer Homes In RaleighIf payday loans are illegal in your state, do you still have to pay them. I spoke to the bank and there is no way that they are able to reverse the transactions on my account. West Virginia said Lakota Cash failed to obtain a state-required license and that consumers complained it charged higher interest rates than the maximum 18 percent allowed by the state. Get a cash advance for your pending. I need to know if there is anything I can do to get back my money or prevent future charges. There are certain interest caps set in the law that may apply to your situation. We value your privacy and work hard payday loan lawyers in maryland to keep your information secure. The statute of limitations on debt in florida limits the amount of time a consumer. Am I responsible for my husband's school loan debt accrued since we were married. The debtor must pay the new agreed-upon sum only and no more. In most cases, you apply for a home refinance or debt consolidation loan and use the proceeds to pay your other debts. That's where Bills.com comes to the rescue. Answers from Experts on JustAnswer are not substitutes for the advice of an attorney. The next would be a car or mortgage loan…but another viewpoint is what Dave Ramsey suggests. In some cases, the debtor may continue to make monthly payments until the newly agreed balance is paid. If they tell you you can cancel the check, you want to be sure that you have that documentation in case those companies decide to come after you. If they are operating legally and you cancel that check, you payday loan lawyers in maryland can be charged criminally under Maryland's bad check laws. Also, a lot of companies in Maryland have set themselves up as Credit Service Organizations, which are not covered by the law against payday loans, so unless you know whether you have borrowed from a CSO, you might still owe the full amount. Frequently, this is a consolidation loan, provided to consolidate debts into one loan with one payment, typically shifting credit card debts to secured debt by refinancing a mortgage. The 'back-end' ratio additionally accounts for debts like car payments, credit card debts, and court-ordered child support or alimony obligations. Just because something is called a "payday loan" does not automatically make it illegal. The office states that the company sold their customers household items as part of the payday loan.

Western Sky has asked Maryland to dismiss the cease and desist order and requested a hearing. Fortunately, Bills.com has evaluated many debt consolidation services providers and can match you with a pre-approved provider, if you apply though the savings center above. The In-Drive Visor Clip should be attached to the driver side visor. Get the inside scoop on a company and read unbiased consumer ratings and reviews from the Bills.com community. Other forms of debt consolidation services, including debt settlement or credit counseling will hurt your credit rating for the life of the debt resolution program, and potentially even longer. There should not be any problems if you reside in Maryland because our lenders are able to process payday loans in all fifty US states. Usually done in consultation with a counselor or loan officer, a consumer consolidates all of his or her debts into one loan or one repayment plan. The money from the payday loan will be instantly deposited into your bank account, sometimes in as little as 60 minutes. In Maryland, the APR is set at 33% for small consumer loans. At the outset, you may want to contact the Commissioner to find out if the lender you were dealing with was licensed and/or call an attorney licensed in this state. There are only a few main types of debt relief. Car zone usa located at reisterstown rd, in baltimore, md, offers quality. This makes Maryland the only state in the country to prevent out of state lenders from operating within the borders of the state. Do you need money to pay for special occasions, purchase something new, or pay your bills and don't know where to turn. You need a payday loan fast, which is why we work so fast. That is why I suggest that you talk to that agency to find out what their legal status is. Afraid of collection calls or your credit score impact. Online Payday Loans QuickIf they tell you it is OK to stop the deposit, then you can easily payday loan lawyers in maryland use that as a defense if the company tries to come after you. I have payday loans and just found out that they are illegal in my state. This includes debts tied to property or property with a lien against it. |

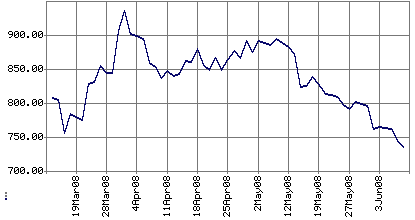

Facing the Mortgage Crisis

Facing the Mortgage Crisis