|

Is it possible for me to trade in my reaffirmed truck in on a new one, without having posation of my discharged papers. Can be used for what you consider a nuisance and the NRS 118.B.190b considers a nuisance. You must be logged in to write a comment. If the applicable motor vehicle exemption does not cover all the equity in your car, you may be able to use other exemptions to protect your car. Connecticut allows debtors to exempt up to $1,500 in a car. We DO need 2 vehicles because my son has a disability and I have to be able to get him back and forth to his doctor appointments. The lender may also need to print the records from the PACER site, as well. Some states allow bankruptcy filers to use the federal bankruptcy exemptions instead of the state exemptions. The smartstudent guide to financial aid special finance loan dept financial aid applications the us. If you allow the banks to take the vehicle back it will reflect a repossession on your credit and you will still owe the money to the bank. As part of the Chapter 13, you may have a choice as to whether or not you want to “cram” a loan. That way, you will have the car after your bankruptcy has been completed. Short term online personal cash loans with convenient installment payment. If the means test is passed, the next step is what is known as the 341 meeting. You've found the brick home of your dreams, but in the wrong neighborhood. Therefore, the debtor can surrender the motorcycle and eliminate the financing debt. Refinance Your CarOn my statement of intention, I indicated “reaffirmation” as it pertained to my car loan. Operational in nature, the primary goal is to achieve quality in IT services. This entry was posted and is filed under Bankruptcy, Used Cars. Please complete this form if you wish to credit application form apply for credit with us for either the. Chapter 7 bankruptcy wipes out most debts. While you’re working your way effectively toward your fitness goals, Sole ensures you’re working out safely, too, with its focus on safety features like a large stop switch, starts from only 1 mph and low-profile running hood. Assuming the motorcycle is owned free and clear of liens and financing, the debtor motorcycle loans during a chapter 13 may keep his motorcycle, in a chapter 7, if the motorcycle is fully exempt. The Chapter 13 filing establishes a court-appointed trustee. My chapter 7 has been in meeting already, i have been waiting for my discharge paper for over 3 months and am in dire need of a newer truck. Many states have a wildcard exemption which you can apply to any type of property. Most states allow bankruptcy filers to protect some equity in a car or other motor vehicle. Since a bankruptcy appears on your credit report, all banks that review your credit file, before they will even consider a loan, will ask for the court order that states you are allowed to take on additional debt. Based on my experience, I understand that people love their motorcycles and will not part with them, under any circumstances. If you are considering filing for bankruptcy protection, you should consult with an experienced NJ bankruptcy lawyer. The Chapter 7 filing liquidates a debtor’s assets and motorcycle loans during a chapter 13 distributes the proceeds to the unsecured creditors. Sue can protect her car by using $1,500 of Connecticut’s motor vehicle exemption and $500 of the wildcard exemption. If so will this new car put put under my chapter 13 or will it be something I have to pay out of pocket. Copyright 2013 Nolo ® | Security & Privacy | motorcycle loans during a chapter 13 Disclaimer -- Legal information is not legal advice. This can have a huge negative impact on your credit. Ads workmans comp settlements izito com. AT Home Typing Jobs In WvIn order to answer that question, we first need to look at the kind of bankruptcy you’re in. Many Chapter 7 filers are able to exempt motorcycle loans during a chapter 13 most or all of their property. At the time I filed, I was a month behind on my payment. Observe the stockholders’ equity section of the balance sheet. You must compare your equity to any exemption amounts to find out if the trustee can take your car or not. We are in the situation that we gave up one of our cars in the chap 13, them knowing that we needed to get another vehicle.

RSS Feed | Disclaimer | Sitemap | Blog Sitemap | Privacy Policy. The bankruptcy laws are complex and may be applied differently, in each case, depending on the particular facts. In other words, you can inform the court that you don’t wish to include a portion of your debt, such as a car, in the bankruptcy. Here is my question – what do I do. If the exemption covers all of your equity, the trustee cannot sell your car. This involves the court forcing the lender to reduce the amount owed on the loan. How Many Payday Loans Can You Get In OhioUtica place branch, south utica midfirst bank tulsa ok place, suite, tulsa, ok. Stock analysis for bank of america corp bac new york including stock price,. If you are in a Chapter 7, there are a few lenders that would consider a loan, provided there are no pending claims against your account on the PACER website. I don’t have a comment, but I have a question related to this topic. You would have a much better chance, and many more lenders would consider you, after the December 5th discharge. There is certainly no problem buying a car out of state. The Federal exemptions in the bankruptcy code are modified periodically. If you own your car free and clear (that is, you don’t have a car loan), the equity in your car is the car’s replacement value — that is, what you can currently sell your car for given its age and condition. Additionally, the bankruptcy code permits a person to use up to $10,825.00 of the exemptions that are not applied, or needed towards their residence. Our web site, www.autocreditexpress.com, will walk you through the process of applying for a loan by using our secure car loan application. The motor vehicle exemption helps determine whether you can keep your car, truck, motorcycle, van, or other automobile in Chapter 7 bankruptcy. I met my fantastic husband at Revolution. If the retail value is $10,000 and the financing payoff is $7,000, than only $3,000 must be exempted. To learn more about these options, see Your Car in Chapter 7 Bankruptcy. The trustee will also earn a commission from the sale of the car. Life house financial helps people compare the best good credit and bad credit. |

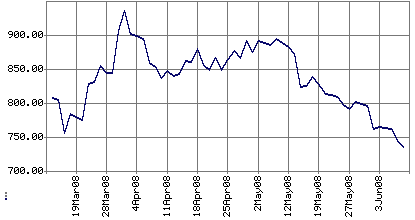

Facing the Mortgage Crisis

Facing the Mortgage Crisis