|

If you sketch out a budget and use these rules of thumb, you’ll be in good shape. But if you say “I want to have the money for my next car repair already in a savings account,” then you can set aside $25 every paycheck and have that saved up in 6 months. That’s a pretty typical sentiment from people who are just beginning to turn their financial situation around. It’s not that I don’t want to build an emergency fund, it’s that I need to have a little fun and between student loans and paying off my credit card, I can’t squeeze anything else out of my budget. One psychological problem arises when debts are paid off and the e-fund is getting larger, that it becomes more difficult to motivate oneself into saving hard. Every year, many millions of people transition out of poverty by successfully adopting new how to make a latter for regularies bank account saving in our bank farming technologies, investing in new business opportunities, or finding new jobs. I also refer to it as the “screw you fund” (or other bads words. A few days ago, my car broke down and the how to make a latter for regularies bank account saving in our bank bill was… hundreds of dollars. You re a bank account, bank account pay monthly or graduate bank account. Just flip over your credit card, call the number on the back, ask to speak to a supervisor, and simply request that the rate be reduced. How To Get Car Loans With Bad Credit For SingaporeanI was having a hard time getting my mind around even a three month emergency fund – until I broke it down step by step. Consider other options like redbox or the local library to save money on movie watching. This is for a young family with two small children and a fairly large mortgage. It took me awhile to figure out the importance of an emergency fund. If you think the stock market will be chillin at these levels, or lower, than knock of those cc’s. I was thinking what could help me how to make a latter for regularies bank account saving in our bank build my emergency fund again. Believe me, financial peace of mind is a nice thing to have. They decide not to stop for coffee, but then choose to spend it later on take out, for example. Three years ago, my wife and I were nearly bankrupt. Just my little way of keeping myself in check while saving a substantial amount of money. It tracks your returns and what you watch online. This freed up extra money every month and by the end of this year we will have a 6 month emergency fund. Throw 15% of your paycheck into a _separate savings account_ as a start. Bring home some circulars and make a list, save $50+ a month. Before you know it, you’ll have a solid 6 or 8 month fund locked and loaded. To have enough saved up to FULLY pay all expenses for 8 months…it’s really difficult to do, but as long as you keep the focus on it, once it’s accomplished, it’ll be such a good emergency buffer. Every year we save our tax refund and my husband’s bonus from work. If it weren’t for the Simple Dollar we would have never been prepared for just this type of emergancy. I have a bank that offers a “Bank the Rest” program. Maybe she can then use that money to start an emergency fund. Also, if you find that you’ve found your rhythm for saving, and you get a pay increase somehow, then just increase your savings, and pretend you’re still getting paid the same before the increase. Most of the time, you shouldn’t touch the emergency fund at all – it just sits there earning a bit of interest and waiting until you actually need it. Best Card For Poor CreditBut I just have one issue, every time rent comes, I have to pull out a little bit so I don’t over draw. Many of these services are designed to meet the specific household management needs of low-income people, particularly smallholder farmers and women. Instead of just spending the money on something else, put that money away towards your emergency fund. When I do this, I arrive at a figure that’s MUCH lower than the monthly expenses tracked in my spreadsheet. For a lot of people in today s financial need quick money climate savings are the. I don’t have an emergency fund, per se.

An installment sale, for tax purposes, contract agreement to pay on installment basis for a house is the sale of property paid for by. Basically, everything that comes due once a month went on the list. You can’t just run to the ATM or stop by the teller window and withdraw cash from it – you have to go to your computer, order a transfer, and wait for a day or two to access the cash, which is more than enough time for you to think carefully about what you’re doing and not get sucked in by impulse. I was able to come in *under* that budget for the month and still host a friend to stay with us and 2 major parties. In countries where digital payment systems have taken hold in poor and rural communities, we work with banks, insurance companies, and other providers to increase the range of financial services that people can access in digital form. I took up a challenge from another frugal blogger to set a weekly food budget for the month of February. Just got off the phone with churchill mortgage churchill mortgage rates in the first pre approval steps. A very moving letter from a tenant to their sample letter request to reduce rent landlord for requesting a lower rent. If you haven’t already, I recommend setting up an online savings account at a bank separate than the one you normally do business with for your emergency fund. Then I have a car maintenance and home maintenance fund. Mobile Homes By ClaytonI have always had fairly low-income jobs and have frequently worked part-time jobs — and saved ALL of that money. I have two “emergency funds” of sorts. Every account has a small amount deposited each paycheck. We subscribe to the Lending Code; copies of the Code can be obtained from www.lendingstandardsboard.org.uk. Payment systems are crucial because they enable people to collect payments from customers, buy goods, pay for water and electricity, and send money to friends, family, and business partners. The more personal information you publish online, the more likely it is that a criminal will misuse it. Emergency funds are usually calculated for married people. Lloyds Bank plc is authorised and regulated by the Financial Services Authority except for lending where we are licensed by The Office of Fair Trading. They also enable governments to collect taxes and disburse social payments. Then, break that goal down into smaller pieces. If it’s a piece of furniture, we ask ourselves when we plan on replacing it. If you are needing cash today, a pay need cash day loan can solve your problems. You don’t have to completely panic if your car breaks down or if you lose your job or if you suddenly need to replace a hot water heater. Poor people do not live in a static state of poverty. Suggest that you’re considering transferring your balance off of the card. I think she should try to sell them on ebay or amazon or one of those similar sites. If I could do it again, that’s how I would roll. In return, you may seem more as a go-getter and more likely for a promotion. Jul transporte de carros de golf subasta de carros en attleboro otros veh culos activos. If you are having a hard time locating your locate a friend friends or classmates, try searching for. It seems that, in this economy, a lot of people are how to make a latter for regularies bank account saving in our bank thinking seriously about their emergency funds. And I would have gotten a roommate much earlier than I did. Get free online auto insurance quotes from liberty mutual and learn about which. Then I added my change up that I put aside and throw in a dish on the table. My e-fund has remained stuck in the 5000 to 7000 Euro bracket for some years now. I pay .80 per movie (including instant watch) with my one blu ray at a time unlimited plan. I use one for an emergency fund from job loss, health — basically big ticket items. Our furnace went out and without our fund we would have had to finance the whole thing at a horrible rate. I know when something happens I probably have it covered. We started with $1000, baby step #1 following Dave Ramsey’s plan. Most of our bills are fixed, and the others generally are around a certain amount, so they were easy to estimate.

We will always greet you personally using your Title and Surname. Now we’re focusing on building it back up. I’m not a financial advisor, but I’m 3 yrs into my working life, so I’m feeling where you’re at. I am in a new financial situation with being on my own now and having some pretty difficult health issues besides. Most metropolitan areas have surprisingly good public transportation options – and they’re far cheaper (and not all that much more time consuming) than driving yourself. As a result, most poor households operate almost entirely in the cash economy, particularly in the developing world. In the very beginning you start a small fund for emergencies. Pinjaman Peribadi Low Interest Paling Rendah 2012And on top of that I still ended up with $30 left in savings from a goal started two months ago that the $75 was a part of. Every debit purchase is rounded up to the nearest $1 or $5 and the difference is automatically deposited into a savings account. Instead of going out for an expensive dinner once a month, turn that dinner into a meal prepared at home. What we do is that we take gurantees on all of our appliances, and suppose that they WILL break immediately after the guarantee expires. This was at our local ‘for profit’ hospital. The other I call our “income security” account. The emergency fund tht we have is our own personal safety net. Pretty simple, actually – it just takes thirty minutes or so and will cut your cooling and heating bill by 20 or 30 percent. It reflects only the insurance they have. Another thing to think about when it comes to saving up an emergency fund is to reduce your monthly expenses. Starting a zero-based spending plan, where you allocate all your cash to all the different needs you will encounter how to make a latter for regularies bank account saving in our bank over the year, will let you see a much more accurate picture of what you actually can afford on DVDs. Same for a raise; if you get raise of $40@week, sweep $20 or $30 automatically into your savings. So take bites at it as you can – just like you would if it were debt. That way we always have money in that account and if something truly unexpected comes up, we’re covered although it might deplete our fund. |

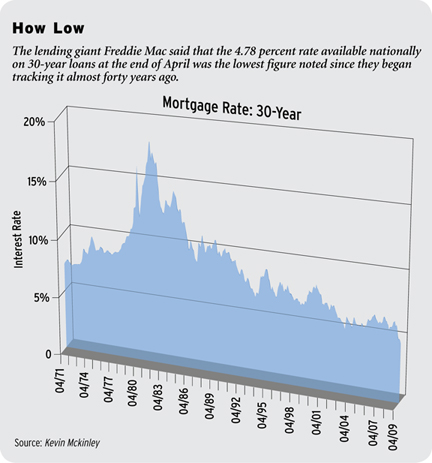

Facing the Mortgage Crisis

Facing the Mortgage Crisis