|

A credit score is one of the most important components of a consumer's financial profile. These factors translate to higher profitability for that company and make that customer more desirable. The law allows you to order one free copy of your report from each of the nationwide consumer reporting companies every 12 months. Please alter your browser's settings to allow Javascript before continuing. I'm beginning to think this is a scam swell because of his automated responses and unreachability. They also must forward all the relevant data you provide about the inaccuracy to the organization that provided the information. Otherwise, a consumer reporting company may charge you up to $11.00 for another copy of your report within a. Other than pulling your credit report on a daily basis, credit monitoring is the best way to know what's happening in your credit report. Self-reliance is one of the most common traits of successful entrepreneurs, and that characteristic extends to business startup funding. Having the highest possible score is crucial, given just how many facets of life your credit standing impacts. By requesting the reports separately, you can monitor your credit more frequently throughout the year. Also, please remember that the negative information in your credit report does not come from Equifax; any negative information is reported to Equifax by others that have granted you credit, is included in public record information or reported by collection agencies. Consumer LoansTherefore, before actually ordering your credit score, you should visit annualcreditreport.com and perform a free credit check online in order to spot any inaccuracies in your credit files. You need to provide your name, address, Social Security number, and date of birth. Watch a video, How to File a Complaint, at ftc.gov/video to learn more. Credit scores are calculated based on data in your credit reports and, as fluid numbers, change over time, sometimes on a daily basis. In some cases, the “free” product comes with strings attached. To maintain the security of your file, each nationwide consumer reporting company may ask you for some information that only you would know, like the amount of your monthly mortgage payment. The Fair Credit Reporting Act guarantees you access to your credit report for free from each of the three nationwide credit reporting companies Experian, Equifax, and TransUnion every 12 months. And because you are pre-selected to receive the offer, you can only be turned down in limited circumstances. That is why our site allows consumers to access their credit score anytime they want for free without the sneaky "free" trials or subscription requirements. Because the information in your credit report is used to evaluate your applications for credit, insurance, free credit check employment, and renting a home, you should be sure the information is accurate and up-to-date. Our online service is available anywhere, anytime, and includes unlimited customer support. Jul writing a reply to a request for an interview sample confirmation letters or meeting appointment may come in. A FICO score is comprised of the following five sections, each of which carries a certain weight. El predio de veh culos en internet m venata de automiles en guatemala s grande de guatemala, con m s de. Nothing works and the cust service is stupid. Ontario Car Loan InfoDID YOU KNOW that three little numbers (your credit score) could end up saving you hundreds, or even thousands, of dollars. Each type of credit check serves a distinct, yet important purpose, and at the end of the day, consumers should utilize all three to their full advantage. Please refer to the information below to learn more about specific credit report information. Credit Karma will continue to provide these free credit scores while doing the most to protect your privacy regardless if you use our other services. Your credit score is kind of an expression of this concept; an index of your credit history. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Getting your Credit Report & Credit Score is the first step in knowing your credit. Do not contact the three nationwide consumer reporting companies individually. The best way to do so is to perform a free credit check online by visiting annualcreditreport.com and requesting the free copy of each of your three main credit files to which you are legally entitled every 12 months. Your browser does not have Javascript enabled. It does not include all terms, conditions and exclusions of the policies described. After the information provider receives notice of a dispute from the consumer reporting company, it must investigate, review the relevant information, and report the results back to the consumer reporting company. Copyright© 2007-2012 Credit Karma™, Inc. Credit Karma believes this is a fundamental consumer right.

All you have to do is show up an bid on the day of the auction. Then, every 90 days, we'll automatically renew your fraud alert request for you. Our services start with a free credit score. The premise of consumer Credit Scoring is that people with good credit pay their bills on time, are less likely to go into collections, and tend to waste fewer company resources overall. The Equifax Credit Score is a proprietary credit model designed by Equifax. It may be calculated using the information contained in free credit check your Equifax, Experian and Transunion Credit Files. Under federal law, you’re entitled to a free report if a company takes adverse action against you, such as denying your application for credit, insurance, or employment, and you ask for your report within 60 days of receiving notice of the action. Only one website is authorized to fill orders for the free annual credit free credit check report you are entitled to under law — annualcreditreport.com. In addition, monitoring your credit is one of the best ways to spot identity theft. Credit Karma offers a new way to track your credit score and a unique way to benefit from it. To take full advantage of your rights under this law, contact the consumer reporting company and the information provider. If you suspect identity theft, you may need to place a fraud alert on your credit report, close compromised accounts, file a complaint with the FTC, or file a police report. These questions are designed to indicate the credit score range into which you are likely to fit, given the types of credit cards you have been approved for in the past, your payment history, and any negative public records that may be attached to your name. 2000 Loan For Bad CreditA strong score is worth money because it saves you in excess costs. As an experienced motor vehicle, car, and ambulance accident lawyer for the last three and a half decades, I can attest to the fact that ambulance drivers do not get a free pass. Texas home loan guide, conventional, financing a motorcycle payments houston tx fha, va mortgage guidelines, credit. If you are looking for a high-quality house but affordable, RCBC can be your option to answer that. Please refer to the actual policies for complete details of coverage and exclusions. The principle of Karma is common to many beliefs. AnnualCreditReport.com is the ONLY authorized source for the free annual credit report that's yours by law. Find out how you can get your free annual credit report. The interior of this home is also in great shape. A consumer reporting company can report most accurate negative information for seven years and bankruptcy information for 10 years. These offers are from advertisers who share our vision of consumer empowerment. The form is on the back of this brochure; or you can print it from ftc.gov/credit. The only 2 parties in this free credit check country are US vs. The score is intended solely for your educational use. Getting your finances sorted with Aussie is quick, easy and we've got competitive rates too. Our advertising partners provide personalized offers and Credit Karma matches them with appropriate people, never disclosing the user information unless the consumer responds to the offer. Because nationwide consumer reporting companies get their information from different sources, the information in your free credit check report from one company may not reflect all, or the same, information in your reports from the other two companies. The FCRA specifies who can access your credit report. Start by visiting the FTC’s identity theft website. Click Here for important product disclosures, limitations,restrictions and conditions that may apply. Some credit card or insurance products may only be available through prescreened offers. Flyers For RefinancingWhen the investigation is complete, the consumer reporting company must give you the written results and a free copy of your report if the dispute results in a change. That's why it's so important to stay on top of your credit reports for changes that could affect your credit scores. The application of heat then melts the laminating plastic, usually Polyvinyl Butyral "PVB" enabling both the glass and the interior film to be recycled. If the information provider finds the disputed information is inaccurate, it must notify all three nationwide consumer reporting companies so they can correct the information in your file. Nationwide consumer reporting companies sell the information in your report to creditors, insurers, employers, and other businesses that use it to evaluate your applications for credit, insurance, employment, or renting a home. When you access the free credit score, Credit Karma will show personalized offers to you based on your credit profile.

This account is designed for fresh start bank account customers looking to rebuild. Monitoring your credit report allows you to stay on top of your credit on a daily basis. A practical example of this is the fact that, according to FICO, the leading credit scoring agency in the U.S., a 100 point difference in your score can cost you $40,000 in interest over the life of a 30-year $300,000 home loan. Your credit score disclosure must be purchased separately. Mar if you are in a lawsuit, which type disability secrets of lawyer would you rather have. If you wish to take advantage of Karma Offers, it is up to you. In addition to free credit scores, Credit Karma™ has a wealth of tools and content to help consumers better understand how credit scores and credit reports work. They are providing free annual credit reports only through annualcreditreport. The general idea is that any action a person takes either positive or negative, will have an inevitable equal effect in the future. |

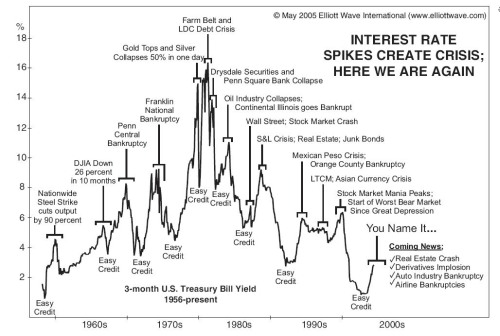

Facing the Mortgage Crisis

Facing the Mortgage Crisis