|

Others may misrepresent the terms of a debt consolidation loan, failing to explain consolidate credit cards certain costs or mention that you're signing over your home as collateral. You'll avoid the added costs of repossession and a negative entry on your credit report. If you decide to pay a company to negotiate your debt, do some research. Auto Loan ApplicationAnd that's presuming you don't charge another thing during that time. After you have made all the payments under the plan, you receive a discharge of your debts. Debt settlement firms often pitch their services as an alternative to bankruptcy. Depending on your financial condition, the amount of any savings you obtain from debt relief services can be considered income and taxable. Watch a video, How to File a Complaint, at ftc.gov/video to learn more. Only time and a conscientious effort to repay your debts will improve your credit report. Also, before you file a Chapter 7 bankruptcy case, you must satisfy a "means test." This test requires you to confirm that your income does not exceed a certain amount. Start by listing your income from all sources. A debt collector may not call you before 8 a.m., after 9 p.m., or while you're at work if the collector knows that your employer doesn't approve of the calls. But legitimate creditors never guarantee that the consumer will consolidate credit cards get the loan — or even represent that a loan is likely. It is true that many legitimate creditors offer extensions of credit through telemarketing and require an application or appraisal fee in advance. Attorney fees are additional and can vary. For more information visit www.uscourts.gov/bankruptcycourts/fees.html. Get fast cash loans online right here. Many companies appeal to consumers with poor credit histories, promising to clean up credit reports for a fee. How do you know which will work best for you. One downside is that your reduced payment plan will probably show up as a mark against you on your credit report. Cooperative Extension Service operate nonprofit credit counseling programs. And to successfully lower your debt load, you'll need to pay far more than the smallest amount the card company will accept, especially after that zero rate disappears. But if you just can't get a handle on your bills by yourself, you should explore credit counseling. Most lenders are willing to work with you if they believe you're acting in good faith and the situation is temporary. Just be sure to do your homework to guarantee that the home equity dollars and cents make sense. The goal is to make sure you can make ends meet on the basics. They may claim that using their services will have little or no negative impact on your ability to get credit in the future, or that any negative information can be removed from your credit report when you complete their debt negotiation program. If you fall behind on your mortgage, contact your lender immediately to avoid foreclosure. A DMP alone is not credit counseling, and DMPs are not for everyone. Some agencies limit their counseling services to homeowners with FHA mortgages, but many offer free help to any homeowner who's having trouble making mortgage payments. And they must honor a written request from you to stop further contact. Sample Of Authorization LetterMar if you are in a lawsuit, which type disability secrets of lawyer would you rather have. If you're thinking about getting help to stabilize your financial situation, do some homework first. In fact, if you stop making payments on a credit card, late fees and interest usually are added to the debt each month. A direct auto loan is where a bank gives the loan directly to a consumer. Even though your creditor agreed to the reduced payment, you technically did not pay your account as called for in your original credit agreement. If you can't do this, the creditor may sell the car. Car LetterThat can result in a negative entry on your credit report. Ask the credit counselor to estimate how long it will take for you to complete the plan. In a DMP, you deposit money each month with the credit counseling organization, which uses your deposits to pay your unsecured debts, like your consolidate credit cards credit card bills, student loans, and medical bills, according to a payment schedule the counselor develops with you and your creditors. It depends on your level of debt, your level of discipline, and your prospects for the future. Even if a DMP is appropriate for you, a reputable credit counseling organization still can help you create a budget and teach you money management skills. It feeds upon the tendencies that got you in trouble in the first place.

Collectors may not harass you, lie, or use unfair practices when they try to collect a debt. Even if you do qualify for a zero-percent or similar single-digit rate, it won't last forever. People that have taken on too much debt tend to go into denial; they'd rather not know how much debt they owe. The Fair Debt Collection Practices Act is the federal law that dictates how and when a debt collector may contact you. You may have to agree not to apply for — or use — any additional credit while you're participating in the plan. Jul i saw a tv add that said you could get a new car for dollars down and. Both also provide exemptions that allow people to keep certain assets, although exemption amounts vary by state. Apr chapter bankruptcy helps individuals, chapter 13 nc end of auto lease or small business owners, who desire. At that point, your creditors consolidate credit cards have given up on you. A successful DMP requires you to make regular, timely payments, and could take 48 months or more to complete. Here are some popular forms of debt consolidation, how they work and a look at their pros and cons. Disability SecretsThis can cause your original debt to double or triple. Some lenders may reduce or suspend your payments for a short time. In some instances, when creditors win a lawsuit, they have the right to garnish your wages or put a lien on your home. Some debt settlement companies may claim that they can arrange for your debt to be paid off for a much lower amount – anywhere from 30 to 70 percent of the balance you owe. Here are the things to consider if you want to consolidate your credit card debt. This fighting-fire-with-fire approach can take several forms. Online Loans Bad CreditGet a debt consolidation loan to consolidate your credit card debt. Make sure that the debt management or credit counseling firm answers all your questions and that you have a firm understanding of how the process will work and what it will cost. Unsecured debts are not tied to any asset, and include most credit card debt, bills for medical care, signature loans, and debts for other types of services. Finally, the Internal Revenue Service may consider any amount of forgiven debt to be taxable income. By taking on yet another creditor, you're adding the proverbial fuel to the fire. Some businesses that offer to help you with your debt problems may charge high fees and fail to follow through on the services they sell. If you see default approaching, you may be better off selling the car yourself and paying off the debt. Apr i recently observed the advertisements kabbage instant cash for kabbage on ebay and tried to and. Also ask the service for references and then confirm them. However, bankruptcy information (both the date of your filing and the later date of discharge) stay on your credit report for 10 years, and can make it difficult to obtain credit, buy a home, get life insurance, or sometimes get a job. To find a reputable firm, verify certifications or third-party registrations. Contact your creditors immediately if you're having trouble making ends meet. Other lenders may agree to change the terms of the mortgage by extending the repayment period to reduce the monthly debt. The FTC works to prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them. |

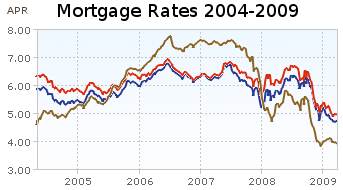

Facing the Mortgage Crisis

Facing the Mortgage Crisis