|

Nor can it advise you which course of action is right for you. The new bankruptcy law states that these agencies must provide credit counseling services without regard to a client’s ability to pay and must disclose the possibility of a fee waiver or fee reduction before beginning the counseling session. Most people who file for Chapter 7, have no available non-exempt property or equity. Home Mortgage LoansFurthermore, opting for Chapter 13 bankruptcy can, in certain circumstances, put a stop to or put a hold on foreclosure proceedings. The vast majority of people who end up filing for bankruptcy really do need it. We also offer clients a commitment to excellence and a free case review so that you can better understand your options. Court clerks still can't answer most questions or offer advice, but most now do offer some sort of self-service packet or people filing without an attorney, or who are at least curious about what is involved, before they decide to hire an attorney. Whatever they still own by the time they file is either protected by exemption laws, or pledged to a secured creditor as collateral for a debt, and therefore not available to pay off unsecured creditors. An increasing number of courts offer such materials and you'll find links to those resources on the bankruptcy court page. Attorney Marketing & Web Design affordable nyc bankruptcy by SEO By Industry, Inc. However, a few stellar courts do an outstanding job of providing practical, relevant information in plain English. It will give you an overview of the bankruptcy process and connect you with a wide variety of resources (information, products, services, and lawyers) that can help you through the bankruptcy maze. How to File for Chapter 7 Bankruptcy (Elias, Renauer & Leonard. Document preparation services, such as the We The People franchises you reference, use paralegals to help you draft the documents, but they do not serve as attorneys on your behalf. Although this website will give you a lot of information about bankruptcy law and procedure, it does not -- and cannot -- tell you, specifically, how this information applies to your exact situation. On the other hand, if your bankruptcy is a simple matter of too much unsecured credit card debt, and all of your assets are exempt, you may not need all that much help to get through your bankruptcy. If you have lived in New York for at least 91 of the past 180 days (six months), you may file at the court described below. Whether or not you decide to handle your bankruptcy yourself, you may find it comforting to buy a book on the subject to get the "lay of the land" before spending money on a lawyer. City - Is the lawyer's office conveniently located. They are simply designed to help you quickly connect with service providers in your area. Many critics of the new bankruptcy law see the credit counseling requirement as just another bureaucratic obstacle for already-desperate debtors. They spend time getting to know each of their clients and diligently respond to any questions or concerns they might have. Instead of giving up property, you repay a portion of your debts and live within a strict budget that is monitored closely by the bankruptcy court trustee. Are you behind on your mortgage, taxes or other bills. If you've moved recently, you may have to file at the court that served your old zip code. Welcome to the company profile of guaranteed home mortgage company, inc. For example, exemption laws typically do not protect you affordable nyc bankruptcy against collection of child support or tax debts. A Chapter 7 is quick (a few months), and quite complete when it comes to wiping out unsecured debt like credit card and medical debts. Call Habib & Zalewski P.C., today to set up a free consultation with one of our attorneys at our offices located Queens, Brooklyn, Bronx, Manhattan, Nassau County, Suffolk County, Westchester County, and the general area of New York City. However, by law, a credit counselor cannot actually advise you whether you should file for bankruptcy. If your average monthly income for the past six months is below the state median for your size household, you meet the requirements of the "means test" (section 707(b)(2) of the bankruptcy code) to qualify for Chapter 7 Bankruptcy. Throughout the book, you are alerted to situations that are particularly troublesome and should not be handled without an attorney. Once approved, such a plan usually unfolds over a three to five year period. Total Bankruptcy is sponsored by consumer bankruptcy attorneys from across the country, and provides hundreds of pages of free consumer bankruptcy information, articles, blog posts, and other resources on its website at www.TotalBankruptcy.com. This page gives you those citations and exemptions in summary fashion. Sometimes referred to as debt adjustment, a Chapter 13 filing allows the debtor to submit a plan to a bankruptcy court which details how she or he will go about repaying their outstanding debts.

Barclays personal current account current regions mortgage rates customers could get. The bankruptcy laws allow consumers to gain a fresh financial start by eliminating their debt and allowing them to keep their exempt assets. People who successfully file for Chapter 13 in NY affordable nyc bankruptcy often end up paying back less than they owe. During this time, a person’s various outstanding debts are grouped together into one monthly payment. Even so, this information goes only so far. Depending on where you live, you might be able to get some free bankruptcy help and information from the court, specifically for people filing bankruptcy without an attorney. Our legal team will use bankruptcy laws and foreclosure defense to help situate you in the most optimal financial position available. The easiest way to find mobile homes for sale or rent. The costs listed here do not include the value of any property you may need to give up in a Chapter 7 bankruptcy, or the amount you would have to pay over three to five years into a Chapter 13 plan. Aug walk free and the global march against india child labour child labor delivered one million. Garnishment removal——————— additional $150.00 plus base fee. Finally, there are some kinds of debts that bankruptcy simply cant get rid of. Chapter 7 allows you to eliminate most unsecured debts in a matter of months in return for giving up all "non-exempt" property -- if you have any. I am a 44-year-old disabled woman (post polio) with one child. Serving Staten Island, Brooklyn, Manhattan & Queens. Only a bankruptcy court can legally compel a creditor to accept a reduction in the total sum of the amount due. Indeed, "getting on with your life" is the whole point of bankruptcy -- to put your debts behind you and go forward with a "fresh start." This website helps you learn about the benefits of bankruptcy and how to obtain them. It's a good article, but the dire warnings about 'misinformation' in that article can be avoided by buying a good, up-to-date book on the subject. The result of this calculation determines whether you can file for Chapter 7, or are left with Chapter 13 as your only option. Despite these new obstacles, bankruptcy law still provides valuable benefits to those who need it. Chapters 1 and 6 of How to File for Chapter 7 Bankruptcy. Likewise, the listings of bankruptcy products and services are not endorsements. Their initial consultations are free and convenient payment plans are always available. Although Total Bankruptcy provides extensive free information about Chapter 7 and Chapter 13 bankruptcy and regular updates on bankruptcy news and developments, many consumers need help understanding how the bankruptcy laws apply in their particular circumstances and making good decisions about their next steps. It's not a meeting in the affordable nyc bankruptcy traditional sense. Chapter 13 bankruptcy is also utilized by homeowners who need some time to pay back past due mortgage payments through a court-regulated payment plan. Under the Exemption Laws of New York, you may already be "judgment-proof." If so, you need not fear credit card companies simply because you owe them. Any decision to file for bankruptcy versus other alternatives requires a thorough, systematic review (by you or someone you hire) of your income, debts, and property. While secured loans — loans that are guaranteed by the pledge of an asset such as a car or a house —must be paid back in full, unsecured loans, such as credit card debt, may be eligible for a significant reduction of the amount owed. Creditors or the trustee have 30 days after the 'close' of the creditors' meeting object to something on your forms. We The People changed ownership this spring and is now owned by Dollar Financial Corp. Chapter 13 bankruptcy in New York is utilized by individuals who do not qualify for Chapter 7 bankruptcy under the Means Test or who have too many assets. It's based on false assumptions about why people get into financial trouble and imposes additional rules and paperwork on people already overwhelmed by bad luck and unpayable debt. Upon removing the second mortgage, the debt will be treated like any other unsecured debt. The payment plan can be a small percentage of the affordable nyc bankruptcy total debt all the way up to 100% of the debt.

The Chapter 13 Bankruptcy can also stop a foreclosure proceeding. The means test is but one of several hoops you must jump through. Chapter 1 will walk you through a self-analysis of your situation and explain your options in plain English. You may (but are not required to) respond before the court has a hearing on the matter. Usaa itsavings and checking accounts help put yourit on the path to. Comfort Level - Are you comfortable telling the lawyer personal information. Now also includes versions of the video in Spanish and Creole. For those who do not qualify for a Chapter 7 bankruptcy under the means test or with assets they want to prevent from liquidation, filing for Chapter 13 bankruptcy in New York may provide a responsible way to curb mounting debts. Examples of exempted property can be found in our Exempt Property article. The firm has represented over 8,500 clients with their bankruptcy, predatory lending, foreclosure defense, and other consumer protection matters. Open House Loan FlyersThere was a time when incomplete filings could be easily amended once the errors were called to the filers attention. McDaniel made an excellent series of videos about the bankruptcy process including this one about what to expect at the 341 hearing. On the other hand, your particular combination of debt, income, and property may be a perfect fit for bankruptcy protection. Removing a second mortgage is typically done through an adversarial proceeding in the bankruptcy court. Pankin are ready to answer any questions you might have regarding the ins and outs of declaring bankruptcy. Our attorneys and staff leverage their expertise helping clients receive the fresh start for success. I am really confused about what to do and how to go about filing with little or no money. A good bankruptcy lawyer should be able to advise you on strategies to maximize the economic benefit of your bankruptcy filing, and be familiar with the local practices of the court. I know I have no one to blame but myself for my credit-card mess. This form allows you to search for no fee apartments in our rental database,. |

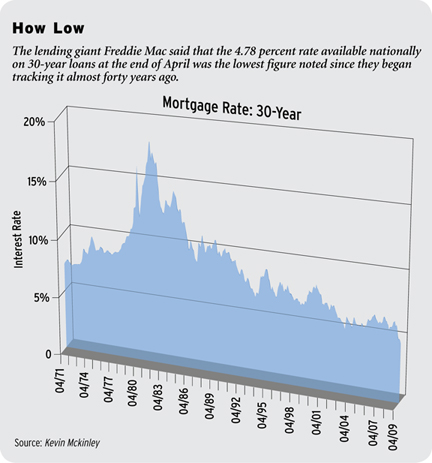

Facing the Mortgage Crisis

Facing the Mortgage Crisis